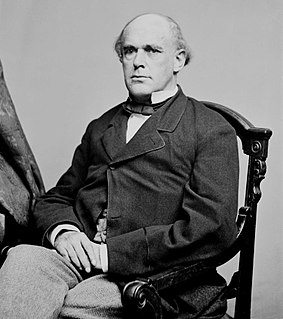

A Quote by Salmon P. Chase

If Congress sees fit to impose a capitation, or other direct tax, it must be laid in proportion to the census; if Congress determines to impose duties, imposts, and excises, they must be uniform throughout the United States. These are not strictly limitations of power. They are rules prescribing the mode in which it shall be exercised... This review shows that personal property, contracts, occupations, and the like have never been regarded by Congress as proper subjects of direct tax.

Related Quotes

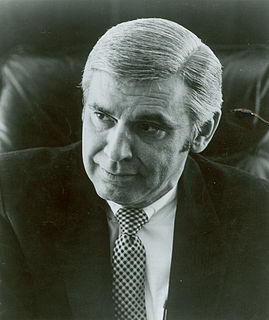

I don't think this is a situation where you can say that Congress was avoiding any mention of the tax power. It'd be one thing if Congress explicitly disavowed an exercise of the tax power. But given that it hasn't done so, it seems to me that it's - not only is it fair to read this as an exercise of the tax power, but this court has got an obligation to construe it as an exercise of the tax power if it can be upheld on that basis.

We've got a tax code that is encouraging flight of jobs and outsourcing. And that's why we've specifically recommended in this campaign that Congress change our tax code so that we stop giving tax breaks to companies that are moving to Mexico and China and other places, and start putting those tax breaks into companies that are investing here in the United States.

The other General Welfare Clause is in the first of the authorities given to the Congress and it's not a grant, it's a restriction. By which I mean it doesn't say Congress can legislate for the general welfare, it means that everything Congress must do has to enhance the general welfare of the United States of America. It can't grant things to individuals, it can only legislate for the government.

Congress is supposed to fund the IRS, and it has been steadily reducing the number of auditors and tax collectors the IRS has at the very time that the tax system has become vastly more complicated. And of course America continues to grow, so there's an increasing number of tax returns coming in. The IRS responds by doing exactly what Congress expects of them. That shouldn't surprise anyone. All bureaucracies do what they are told.

President's personal staff has a unique role. They're his intimate personal advisers, and the tradition and the precedent has been, even when I was national security adviser, that people in that position do not testify before the Congress. They talk to the Congress. They have meetings with the Congress.

Be it enacted by the Senate and House of Representatives of the United States of America in Congress assembled, That (a) the President of the United States is authorized to present, on behalf of the Congress, a gold medal of appropriate design to the family of the late Honorable Leo J. Ryan in recognition of his distinguished service as a Member of Congress and the fact of his untimely death by assassination while performing his responsibilities as a Member of the United States House of Representatives.

Justice [Sonia]Sotomayor said, "Let's talk - you want to talk about the tax power."And I got like a 10-minute run on the tax power. And, boy, was I glad I did because I was able to get across this idea that, yes, this is a narrower ground on which you can affirm it. And I think everybody agrees. I think even the dissenting justices ultimately in the case agreed that, if Congress had expressly called it a tax, it would be indisputably constitutional.

If Congress were to pass a 'flat' tax, you'd simply pay a fixed percentage of your income, and you wouldn't have to fill out any complicated forms, and there would be no loopholes for politically connected groups, and normal people would actually understand the tax laws, and giant talking broccoli stalks would come around and mow your lawn for free, because Congress is NOT going to pass a flat tax, you pathetic fool.

President Barack Obama couldn't bring everything into existence through Congress. Because from the day that he was elected president of the United States, the United States Congress, many of the Republicans met, and they declared that they would never allow his legislative program to succeed. And for eight years they fought him.