A Quote by Louis Bachelier

There is no useful information contained in historical price movements of securities.

Quote Topics

Related Quotes

The most realistic distinction between the investor and the speculator is found in their attitude toward stock-market movements. The speculator's primary interest lies in anticipating and profiting from market fluctuations. The investor's primary interest lies in acquiring and holding suitable securities at suitable prices. Market movements are important to him in a practical sense, because they alternately create low price levels at which he would be wise to buy and high price levels at which he certainly should refrain from buying and probably would be wise to sell.

Data isn't information. ... Information, unlike data, is useful. While there's a gulf between data and information, there's a wide ocean between information and knowledge. What turns the gears in our brains isn't information, but ideas, inventions, and inspiration. Knowledge-not information-implies understanding. And beyond knowledge lies what we should be seeking: wisdom.

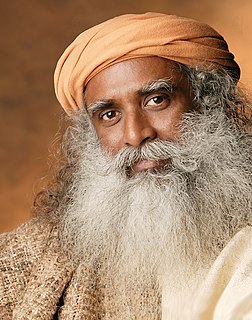

All thoughts are just junk. Essentially, they are coming from the limited experience of past. These thoughts are useful for your survival process. You've picked up some amount of information; you want to survive in the world; this information is useful. If you're looking at life itself, these thoughts are meaningless.

Change depends on people knowing the truth. Change depends on people speaking that truth out loud. That's what movements do. Movements educate people to the truth. They pass along information and ideas that many others do not know, and they cause them to ask questions, to challenge their own long-held beliefs. ... Movements are the way ordinary people get more freedom and justice. Movements are how we keep a check on power and those who abuse it.

You know, entropy is associated thermodynamically, in systems involving heat, with disorder. And in an analogous way, information is associated with disorder, which seems paradoxical. But when you think about it, a bit of information is a surprise. If you already knew what the message contained, there would be no new information in it.

I once read about a meeting of economists who agreed that if their forecasts were 33 1/3 % correct, that was considered a high mark in their profession. Well, of course, I know you cannot invest in securities successfully with odds like that against you if you place dependence solely upon judgement as to the right securities to own and the right time or price to buy them. Then, too, I read somewhere about the man who described an economist as resembling ‘a professor of anatomy who was still a virgin.’