A Quote by Mark Zandi

The average credit score of today's FHA borrowers is higher than the average American household with a score. As it becomes more costly and difficult to get a FHA loan, loans from private mortgage lenders will become more attractive and their market share will grow.

Related Quotes

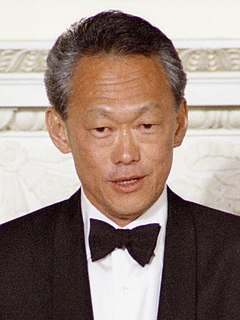

The Bell curve is a fact of life. The blacks on average score 85 per cent on IQ and it is accurate, nothing to do with culture. The whites score on average 100. Asians score more. The Bell curve authors put it at least 10 points higher. These are realities that, if you do not accept, will lead to frustration because you will be spending money on wrong assumptions and the results cannot follow.

I had begun to worry about the housing market back in 2003, when lenders first resurrected interest-only mortgages, loosening their credit standards to generate a greater volume of loans. Throughout 2004, I had watched as these mortgages were offered to more and more subprime borrowers - those with the weakest credit.

A consolidation makes sense only if you can lower your overall interest rate. Many people consolidate by taking out a home equity line loan or home equity line of credit (HELOC), refinancing a mortgage, or taking out a personal loan. They then use this cheaper debt to pay off more expensive debt, most frequently credit card loans, but also auto loans, private student loans, or other debt.

Both HUD and the Department of Justice began bringing lawsuits against mortgage bankers when a higher percentage of minority applicants than white applicants were turned down for mortgage loans. A substantial majority of both black and white mortgage loan applicants had their loans approved but a statistical difference was enough to get a bank sued.

It bothers me that the average fan, the average sportswriter for that matter, pays so much attention to what's in a box score. A box score does not properly represent the most important thing - team play. It shows some guy scoring 27 points, but it doesn't show that my 27-point man let his guy score 30.

According to the Tax Foundation, the average American worker works 127 days of the year just to pay his taxes. That means that government owns 36 percent of the average American's output-which is more than feudal serfs owed the robber barons. That 36 percent is more than the average American spends on food, clothing and housing. In other words, if it were not for taxes, the average American's living standard would at least double.

Too-easy credit and millions of bad loans made during the U.S. housing bubble paved the way for the financial calamity and Great Recession that followed. Today, by contrast, credit is too tight. Mortgage loans are particularly hard to get, creating a problem for the housing market and the broader economy.