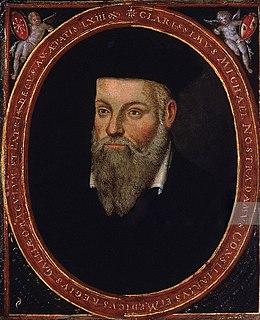

A Quote by Nostradamus

The inflated imitations of gold and silver, which after the rapture are thrown into the fire, all is exhausted and dissipated by the debt. All scrips and bonds are wiped out. At the fourth pillar dedicated to Saturn, split by earthquake and flood: vexing everyone, an urn of gold is found and then restored.

Related Quotes

My treasure chest is filled with gold.

Gold . . . gold . . . gold . . .

Vagabond's gold and drifter's gold . . .

Worthless, priceless, dreamer's gold . . .

Gold of the sunset . . . gold of the dawn . . .Gold of the showertrees on my lawn . . .

Poet's gold and artist's gold . . .

Gold that can not be bought or sold -

Gold.

Monetary reform, if it is to be genuine and successful, must sever money and banking from politics. That's why a modern gold standard must have: no central bank; no fixed rations between gold and silver; no bail-outs; no suspension of gold payments or other bank frauds; no monetization of debt; and no inflation of the money supply, all of which have proved so disastrous in the past.

When you own gold you're fighting every central bank in the world. That's because gold is a currency that competes with government currencies and has a powerful influence on interest rates and the price of government bonds. And that's why central banks long have tried to suppress the price of gold. Gold is the ticket out of the central banking system, the escape from coercive central bank and government power.

The intelligent have a right over the ignorant, namely, the right of instructing them. The right punishment of one out of tune, isto make him play in tune; the fine which the good, refusing to govern, ought to pay, is, to be governed by a worse man; that his guards shall not handle gold and silver, but shall be instructed that there is gold and silver in their souls, which will make men willing to give them every thing which they need.

The obsession with gold, actually and politically, occurs among those who regard economics as a branch of morality. Gold is solid, gold is durable, gold is rare, gold is even (in certain very peculiar circumstances) convertible. To believe in thrift, solidity and soundness is to believe in some way in the properties of gold.

Over the past decade or so, you have seen the flip side of that as you've seen stock prices have come down a lot relative to gold. Now you are getting a change where people are more comfortable holding gold because in the rear-view mirror it doesn't look so bad for gold. Bonds have not come down as much relative to gold, but I think the bond bubble is going to burst and will be falling for years too. And gold will look that much better.

When I was on tour, people would say "We don't need a value-based currency, we can go out and buy gold and silver with US dollars now." I mean that it is so utterly brain dead, because they miss the whole point: the reason we need to have a gold and silver based currency is to bring discipline to the financial system so the government can't go out and do all sorts of bad things.