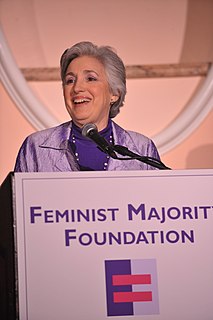

A Quote by Paul Krugman

[D]ebt increases that didn't arise either from war or from extraordinary financial crisis are entirely associated with hard-line conservative governments.

Related Quotes

As I write in 2012 we certainly do not believe that it is over yet, and the worst may be yet to come. Efforts by governments to solve the underlying problems responsible for the crisis have still not gotten very far, and the 'stress tests' that governments have used to encourage optimism about our financial institutions were of questionable thoroughness.

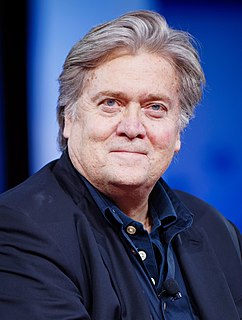

I believe the world, and particularly the Judeo-Christian West, is in a crisis. And it is a crisis of - both of capitalism, but really of the underpinnings of the Judeo-Christian West and our beliefs. We are in an outright war against jihadists, Islam, Islamic fascism. And this war is, I think, metastasizing almost far quicker than governments can handle it.

Nowhere does it say that investors should strive to make every last dollar of potential profit; consideration of risk must never take a backseat to return. Conservative positioning entering a crisis is crucial: it enables one to maintain long-term oriented, clear thinking, and to focus on new opportunities while others are distracted or even forced to sell. Portfolio hedges must be in place before a crisis hits. One cannot reliably or affordably increase or replace hedges that are rolling off during a financial crisis.