A Quote by Paul Manafort

You talk to tax attorneys who are not politically motivated, and they will tell you they would never advise their client to release any tax information in the course of an audit.

Related Quotes

I support both a Fair Tax and a Flat Tax plan that would dramatically streamline the tax system. A Fair Tax would replace all federal taxes on personal and corporate income with a single national tax on retail sales, while a Flat Tax would apply the same tax rate to all income with few if any deductions or exemptions.

If Congress were to pass a 'flat' tax, you'd simply pay a fixed percentage of your income, and you wouldn't have to fill out any complicated forms, and there would be no loopholes for politically connected groups, and normal people would actually understand the tax laws, and giant talking broccoli stalks would come around and mow your lawn for free, because Congress is NOT going to pass a flat tax, you pathetic fool.

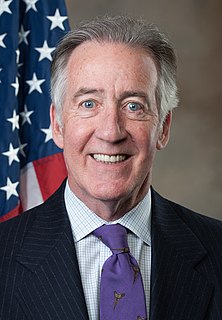

You may have heard that Donald Trum has long refused to release his tax returns, the way every other nominee for president has done for decades. You can look at 40 years of my tax returns. I think we need a law that says, if you become the nominee of the major parties, you have to release your tax returns.

I want to end tax dumping. States that have a common currency should not be engaged in tax competition. We need a minimum tax rate and a European finance minister, who would be responsible for closing the tax loopholes and getting rid of the tax havens inside and outside the EU. It is also clear that we have to reach common standards in our economic and labor policies. We cannot continue to just talk about technical details. We have to inspire enthusiasm in Germany for Europe.

If you tell people, 'that old banger of yours, we're going to tax the hell out of it,' they'll rightly tell you to get lost. But if you tell people that when they next buy a car, the tax will be adjusted so that the cleanest ones will cost less and the polluting ones will cost more, most people would say 'fair enough.'

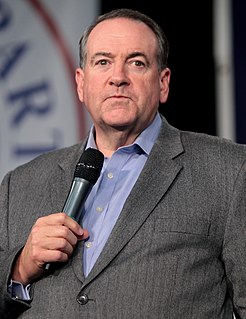

I do think that Republicans are flirting with their tax cut, which has always been the narcotic of Republicans, that they in fact have to at some point, with any remote pretense of candor, abandon any pretense of a balanced budget.I mean, they talk about - because they are going to finance the tax cut by tax cuts. That's how they're going to do it. And I do think that the will is there right now in the Congress to act. I think they will be as close to unity as you will see on Capitol Hill this year.

The 9-9-9 plan would resuscitate this economy because it replaces the outdated tax code that allows politicians to pick winners and losers, and to provide favors in the form of tax breaks, special exemptions and loopholes. It simplifies the code dramatically: 9% business flat tax, 9% personal flat tax, 9% sales tax.