A Quote by Paul Samuelson

Second, they [those who disagree with market efficiency] always claim they know a man, a bank, or a fund that does do better. Alas, anecdotes are not science. And once Wharton School dissertations seek to quantify the performers, these have a tendency to evaporate into the air - or, at least, into statistically insignificant t-statistics.

Related Quotes

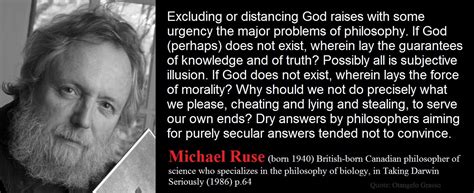

Being a philosophical naturalist does not mean that one thinks that science can provide all of the answers. That is scientism and that is wrong. I don't think a billion buckets of science could speak to the problems raised by the Tea Party. Being a philosophical naturalist does not mean that one thinks that the only truths are those of science. I think the claim just made in the last sentence is true but I don't think it is a claim of science. It means that you use science where you can and you respect and try to emulate its standards.

I won't close down a business of subnormal profitability merely to add a fraction of a point to our corporate returns. I also feel it inappropriate for even an exceptionally profitable company to fund an operation once it appears to have unending losses in prospect. Adam Smith would disagree with my first proposition and Karl Marx would disagree with my second; the middle ground is the only position that leaves me comfortable.

Science is better paid than at any time in the past. The results of this pay have been to attract into science many of those for whom the pay is the first consideration, and who scorn to sacrifice immediate profit for the freedom of development of their own concept. Moreover, this inner development, important and indispensable as it may be to the world of science in the future, generally does not have the tendency to put a single cent into the pockets of their employers.

Experience conclusively shows that index-fund buyers are likely to obtain results exceeding those of the typical fund manager, whose large advisory fees and substantial portfolio turnover tend to reduce investment yields. Many people will find the guarantee of playing the stock-market game at par every round a very attractive one. The index fund is a sensible, serviceable method for obtaining the market's rate of return with absolutely no effort and minimal expense.