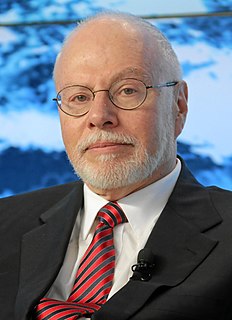

A Quote by Paul Singer

Governments need to be authorized to provide 'open bank assistance.' The convolutions of Dodd-Frank aimed at 'avoiding' this tactic are ludicrous and will prove to be extremely costly to the system.

Related Quotes

Dodd-Frank greatly expanded the regulatory reach of the Federal Reserve. It did not, however, examine whether it was correctly structured to account for these new and expansive powers. Therefore, the Committee will be examining the appropriateness of the Fed's current structure in a post Dodd-Frank world.

Perhaps more to the point for TBTF (Too Big To Fail bank), if a SIFI (Systemically Important Financial Institution) does fail I have little doubt that private investors will in fact bear the losses-even if this leads to an outcome that is messier and more costly to society than we would ideally like. Dodd-Frank is very clear in saying that the Federal Reserve and other regulators cannot use their emergency authorities to bail out an individual failing institution

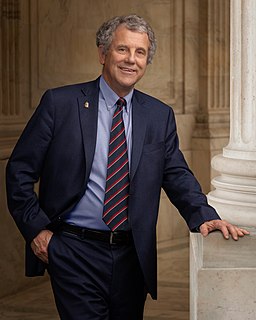

Fannie Mae and Freddie Mac - two bloated and corrupt government-sponsored programs - contributed heavily to the crisis.In order to prevent another crisis, we need to do what we should have done years ago - reform Fannie Mae and Freddie Mac. We also need to repeal Dodd-Frank, the Democrats' failed solution. Under Dodd-Frank, 10 banks too big to fail have become five banks too big to fail. Thousands of community banks have gone out of business.