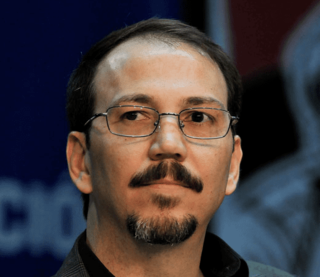

A Quote by Piyush Goyal

If you are moving the informal economy into the formal economy, and if the transactions which for years were never reported as part of GDP are now transacted through banking channels, it will only add to the GDP, not reduce the GDP.

Related Quotes

A possibility is that we see more and more leverage, and credit-to-GDP ratios rise once more to even higher levels; eventually the banking systems of all advanced economies reach magnitudes of 500 percent, 1000 percent or more of GDP, so that every economy starts to have financial systems that resemble recent cases like Switzerland, Ireland, Iceland, or Cyprus. That might be a very fragile world to live in.

For any economy, there are two basic factors determining how many jobs are available at any given time. The first is the overall level of activity - with GDP as a rough, if inadequate measure of overall activity - and the second is what share of GDP goes to hiring people into jobs. In terms of our current situation, after the Great Recession hit in full in 2008, US GDP has grown at an anemic average rate of 1.3 percent per year, as opposed to the historic average rate from 1950 until 2007 of 3.3 percent.

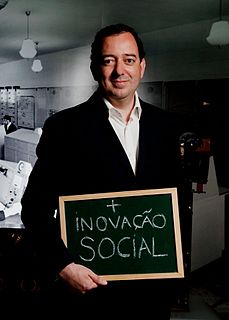

In the eighties and nineties, the innovation agenda was exclusively focused on enterprises. There was a time in which economic and social issues were seen as separate. Economy was producing wealth, society was spending. In the 21st century economy, this is not true anymore. Sectors like health, social services and education have a tendency to grow, in GDP percentage as well as in creating employment, whereas other industries are decreasing. In the long term, an innovation in social services or education will be as important as an innovation in the pharmaceutical or aerospatial industry.