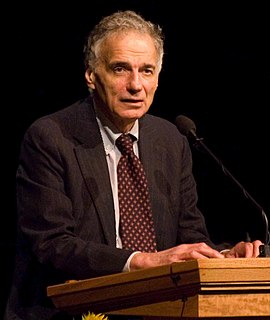

A Quote by Ralph Nader

When people ask, "Why should the rich pay a larger percent of their income than middle-income people?" - my answer is not an answer most people get: It's because their power developed from laws that enriched them.

Related Quotes

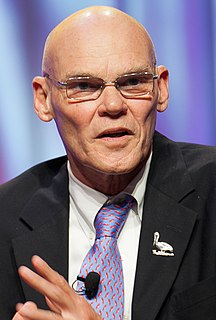

You know, the elites always want to shame the poor - right? - and everyone else. I mean, the fact is, this economy is based on 70 percent of the people driving consumer demand. If people do not purchase goods and services, this economy will grind to recession. And that is why, if you are going to do a tax cut, it ought to really be aimed at low-income and middle-income people.

The people who are having the hard time right now are middle-income Americans. Under the president's policies, middle-income Americans have been buried. They're just being crushed. Middle-income Americans have seen their income come down by $4,300. This is a tax in and of itself. I'll call it the economy tax. It's been crushing.

The richer people, when they get another $100,000, or another million, or 10 million, don't tend to spend it as much as the poorer people would if they got another $100 or $1,000 or $5,000. All the empirical evidence suggests that the rich tend to consume a lower proportion of income than middle and lower-income people.

I agree that income disparity is the great issue of our time. It is even broader and more difficult than the civil rights issues of the 1960s. The '99 percent' is not just a slogan. The disparity in income has left the middle class with lowered, not rising, income, and the poor unable to reach the middle class.

For the three decades after WWII, incomes grew at about 3 percent a year for people up and down the income ladder, but since then most income growth has occurred among the top quintile. And among that group, most of the income growth has occurred among the top 5 percent. The pattern repeats itself all the way up. Most of the growth among the top 5 percent has been among the top 1 percent, and most of the growth among that group has been among the top one-tenth of one percent.

Politicians like to talk about the income tax when they talk about overtaxing the rich, but the income tax is just one part of the total tax system. There are sales taxes, Medicare taxes, social security taxes, unemployment taxes, gasoline taxes, excise taxes - and when you add up all of those taxes [many of which are quite regressive], and then you look at how they affect the rich and the poor, you essentially end up with a system in which the best off 20 percent of Americans pay one percentage point more of their income than the worst off 20 percent of Americans.

Most of the productivity gains appear to go to the top 1 percent. Most people don't have enough income and as a result, they borrow additional money by using their credit card and they fall into high debt. The result of the growing income gap is a slower growing GDP (too few people with money to spend) and a rising tide of indebtedness.