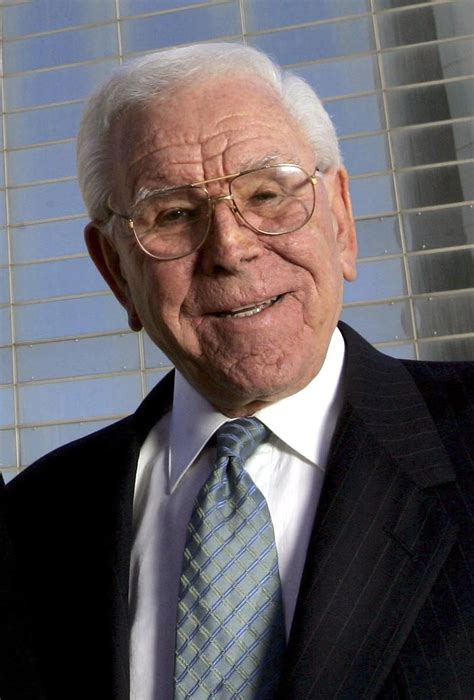

A Quote by Ric Edelman

The people who are taking these loans because it's the only way they can afford their house are exposing themselves to a lot of risk. They're not saving money and they're not building equity, which means they could find themselves in a scenario where they owe more money than their house is worth.

Related Quotes

Now, suppose that a homeowner puts down only 3% of their own money or 3.5% for the FHA. That means if prices go down by only 3%, the house will be in negative equity and it would pay the homeowner just to walk away and say, "The house now is worth less than the mortgage I owe. I think I'm just going to move out and buy a cheaper house." So it's very risky when you have only a 3% or 3.5% equity for the loan. The bank really isn't left with much cushion as collateral.

Let us never forget this fundamental truth: the State has no source of money other than money which people earn themselves. If the State wishes to spend more it can do so only by borrowing your savings or by taxing you more. It is no good thinking that someone else will pay - that 'someone else' is you. There is no such thing as public money; there is only taxpayers' money.

A consolidation makes sense only if you can lower your overall interest rate. Many people consolidate by taking out a home equity line loan or home equity line of credit (HELOC), refinancing a mortgage, or taking out a personal loan. They then use this cheaper debt to pay off more expensive debt, most frequently credit card loans, but also auto loans, private student loans, or other debt.

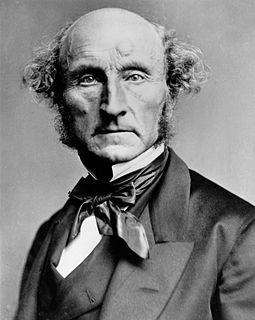

. . . you did not seem to me over-fond of money. And this is the way in general with those who have not made it themselves, while those who have are twice as fond of it as anyone else. For just as poets are fond of their own poems, and fathers of their own children, so money-makers become devoted to money, not only because, like other people, they find it useful, but because it's their own creation.

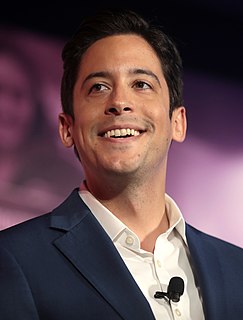

I believe that a lot of people in our society today, people who have been hurt and even people who haven't been hurt, get their worth and value from what they do, what they look like, what they own, what kind of job they have, what kind of house they live in, how much money they have, what social circles they're in, what level of education they have, especially even how other people respond to them. They feel better about themselves if everybody is giving a smiling nod to the way they look and all their choices.