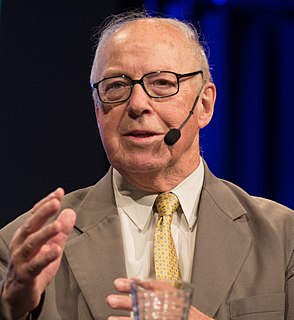

A Quote by Richard N. Haass

Our inability to govern ourselves at home, to deal with everything from infrastructure to our debt to tax policy, is reducing the appeal of the American model.

Related Quotes

Tax reform for the 21st century means rewarding hardworking families by closing unfair loopholes, lowering tax rates across the board, and simplifying the tax code dramatically. It demands reducing the tax burden on American businesses of all sizes so they can keep more of their income to invest in our communities.

We will rebuild our country with American workers, American iron, American aluminum, American steel. We will create millions of new jobs and make millions of American dreams come true. Our infrastructure will again be the best in the world. We used to have the greatest infrastructure anywhere in the world, and today, we are like a third-world country. We are literally like a third-world country. Our infrastructure will again be the best, and we will restore the pride in our communities, our nation.

Any politician that says no tax revenue or zero spending cuts does not deserve reelection. Our hole is so deep in this country with the debt and the debt service, the interest on that debt, before the big expenses come for Social Security and Medicare - for we baby boomers in a few years - that everything has to be on the table.

The U.S. has a law on the books called the debt limit, but the name is misleading. The debt limit started in 1917 for the purpose of facilitating more national debt, not reducing it. It still serves that purpose. It's unconnected to spending, hurts our credit rating and has been an abject failure at limiting debt.

The harsh reality is that we simply cannot tax our way out of our overspending and debt problem. We need a balanced approach that includes both a stronger economy to generate new tax revenues and bipartisan guardrails, which will help ensure that future presidents and congresses spend within our means.

Consider in Washington, around the country today we are talking about balanced budgets, paying down our national debt, getting the economy going, defending ourselves, activist judges. Newt Gingrich did all those things when he was speaker. We got tax relief. We got balanced budgets. We got, you know, job creation. We paid down our national debt.