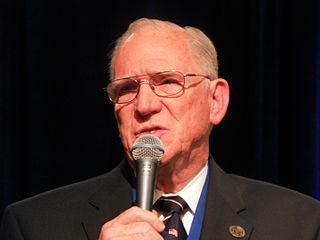

A Quote by Rob Portman

The U.S. has fallen behind with tax policies that haven't been updated in a half-century.

Related Quotes

I would favor three policies: raising the minimum wage to $12, closing the tax loophole where persons only pay a 15% income tax on long term capital gains (tax it at the full tax rate), and institute a progressive tax moving the highest tax rate from 39.6% to 45%. I would favor implementing these three policies in that order, starting with raising the minimum wage, but not stopping there.

There are several states that move from Karl Marx-like policies to Adam Smith-like policies and back again in a weekend. So for the states with huge volatility in their income tax policies over time, the differences in growth rates in those periods are really amazingly consistent with tax rates really mattering.

The result of these ungodly unions was a race of very wicked and very powerful hybrid (half-fallen angel, half-human) offspring - the Nephilim - who corrupted, harassed, even killed mankind. Now, at the end of the 20th century, we have the return of "alien" entities with apparent supernatural powers.

Tax reform for the 21st century means rewarding hardworking families by closing unfair loopholes, lowering tax rates across the board, and simplifying the tax code dramatically. It demands reducing the tax burden on American businesses of all sizes so they can keep more of their income to invest in our communities.

I want to end tax dumping. States that have a common currency should not be engaged in tax competition. We need a minimum tax rate and a European finance minister, who would be responsible for closing the tax loopholes and getting rid of the tax havens inside and outside the EU. It is also clear that we have to reach common standards in our economic and labor policies. We cannot continue to just talk about technical details. We have to inspire enthusiasm in Germany for Europe.

The people who are having the hard time right now are middle-income Americans. Under the president's policies, middle-income Americans have been buried. They're just being crushed. Middle-income Americans have seen their income come down by $4,300. This is a tax in and of itself. I'll call it the economy tax. It's been crushing.

The worst crimes against humanity in the last half of the previous century and this century are carried out with conventional advanced weapons, upgraded daily by a greedy arms industry, super power's apathy and criminal ideologies. In the Middle East, Iran lags behind many other military powers in this respect.

God forbid we should ever be twenty years without such a rebellion... We have had thirteen States independent for eleven years. There has been one rebellion. That comes to one rebellion in a century and a half, for each State. What country before ever existed a century and a half without a rebellion.