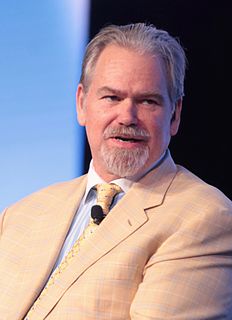

A Quote by Robert D. Arnott

Whatever is newly expensive has two attributes: wonderful past returns and, in most cases, lousy future returns.

Related Quotes

Mitt Romney was treated very unfairly. Mitt Romney didn't want to give his tax returns, because people don't understand returns that are complicated, and complex. And he didn't give it. He fought it, fought it, fought it, all the way into September. A month before the election, he gave his tax returns. And they picked out two items that were absolutely perfect. He did nothing wrong. And his returns are very much smaller than my returns.

The biggest mistake investors make is to believe that what happened in the recent past is likely to persist. They assume that something that was a good investment in the recent past is still a good investment. Typically, high past returns simply imply that an asset has become more expensive and is a poorer, not better, investment.

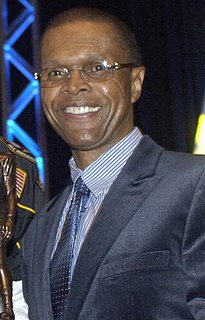

You may have heard that Donald Trum has long refused to release his tax returns, the way every other nominee for president has done for decades. You can look at 40 years of my tax returns. I think we need a law that says, if you become the nominee of the major parties, you have to release your tax returns.