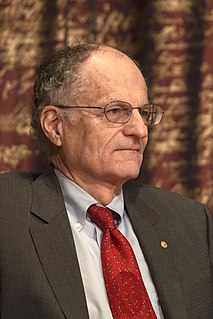

A Quote by Robert J. Shiller

Economists who adhere to rational-expectations models of the world will never admit it, but a lot of what happens in markets is driven by pure stupidity - or, rather, inattention, misinformation about fundamentals, and an exaggerated focus on currently circulating stories.

Related Quotes

In certain circumstances, financial markets can affect the so-called fundamentals which they are supposed to reflect. When that happens, markets enter into a state of dynamic disequilibrium and behave quite differently from what would be considered normal by the theory of efficient markets. Such boom/bust sequences do not arise very often, but when they do, they can be very disruptive, exactly because they affect the fundamentals of the economy.

At the core of an analytical edge is an ability to systematically distinguish between fundamentals and expectations. Fundamentals are a well thought out distribution of outcomes, and expectations are what's priced into an asset. A power metaphor is the [pari-mutuel] racetrack. The fundamentals are how fast a given horse will run and the expectations are the odds on the tote board. As any serious handicapper knows, you make money only by finding a mispricing between the performance of the horse and the odds. There are no 'good' or 'bad' horses, just correctly or incorrectly priced ones.

Probably the only people left who think that economics deserves a Nobel Prize are economists. It confirms their conceit that they're doing 'science' rather than the less tidy task of observing the world and trying to make sense of it. This, after all, is done by mere historians, political scientists, anthropologists, sociologists, and (heaven forbid) even journalists. Economists are loath to admit that they belong in such raffish company.

Until the Great Depression, most economists clung to a vision of capitalism as a perfect or nearly perfect system. That vision wasn’t sustainable in the face of mass unemployment, but as memories of the Depression faded, economists fell back in love with the old, idealized vision of an economy in which rational individuals interact in perfect markets.

If the Humanists wish to be champions of reason, they should consider the following: just as they would not admit mystics into their camp, since no rational discussion is possible with men who substitute supernatural revelations for rational evidence-so they cannot admit advocates of force into their camp, because no rational discussion or agreement is possible with men who substitute guns for rational persuasion.