A Quote by Scott Adams

Related Quotes

I feel no shame at being found still owning a share when the bottom of the market comes…I would go much further than that. I should say that it is from time to time the duty of a serious investor to accept the depreciation of his holdings with equanimity and without reproaching himself. … An investor…should be aiming primarily at long-period results, and should be solely judged by these.

Ask yourself: Am I an investor, or am I a speculator? An investor is a person who owns business and holds it forever and enjoys the returns that U.S. businesses, and to some extent global businesses, have earned since the beginning of time. Speculation is betting on price. Speculation has no place in the portfolio or the kit of the typical investor.

The investor has the benefit of the stock market's daily and changing appraisal of his holdings, 'for whatever that appraisal may be worth', and, second, that the investor is able to increase or decrease his investment at the market's daily figure - 'if he chooses'. Thus the existence of a quoted market gives the investor certain options which he does not have if his security is unquoted. But it does not impose the current quotation on an investor who prefers to take his idea of value from some other source.

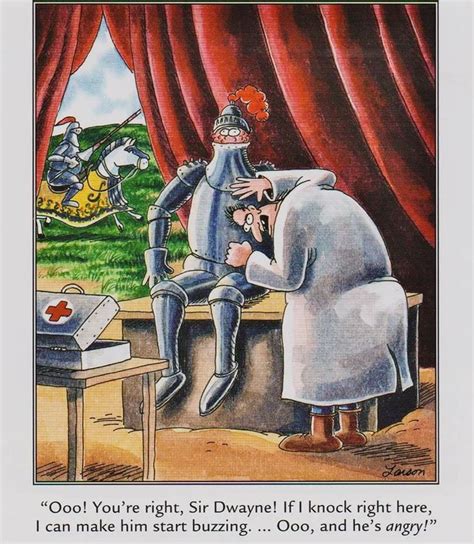

Nature is not primarily functional. It is primarily beautiful. Stop for a moment and let that sink in. We’re so used to evaluating everything (and everyone) by their usefulness that this thought will take a minute or two to begin to dawn on us. Nature is not primarily functional. It is primarily beautiful. Which is to say, beauty is in and of itself a great and glorious good, something we need in large and daily doses.

Here’s how to know if you have the makeup to be an investor. How would you handle the following situation? Let’s say you own a Procter & Gamble in your portfolio and the stock price goes down by half. Do you like it better? If it falls in half, do you reinvest dividends? Do you take cash out of savings to buy more? If you have the confidence to do that, then you’re an investor. If you don’t, you’re not an investor, you’re a speculator, and you shouldn’t be in the stock market in the first place.