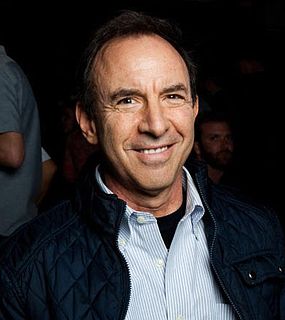

A Quote by Stephen Moore

Ex-Im Bank doles out billions of dollars of loans and insurance subsidies every year and has become the poster child for corporate cronyism in Washington. Think of the bank as food stamps for America's Fortune 500 companies.

Related Quotes

The lobbying over China most favored nation trading status was disgusting. There's no way in hell that MFN would have passed in '95, '96, '97, '98, '99, 2000 if all these companies hadn't come in flooding and making campaign contributions and ask for people's support. That drove the debate. Every year was the allure of corporate dollars flooding into members' bank accounts.

When you say "bank," a bank is a building, a set of computers and chairs and things. The bankers are the people running these banks. They're the chief officers, and they push the loans because they don't care if they go bad. For one thing, they may package these bad loans and sell them off to gullible institutional investors.

If bankers can push the loans and make more profits for the bank, they get paid higher bonuses. They often also get stock options. If the bank goes under, they get to keep all of these salaries and options - and the government will bail out the bank. These guys will take their money and run, which is pretty much what they're doing now.