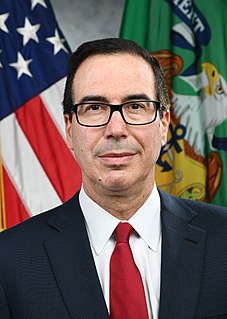

A Quote by Steve Mnuchin

One of the big problems we had during the financial crisis was the intermingling of banks and holding companies and complex securities.

Related Quotes

The Fed has a lot of power in the economy because it has a big impact on the supply and cost of credit, that is, interest rates. It also plays a key role in supervising banks and historically has seemed to take it easy on the banks when it shouldn't have, such as in the lead up to the financial crisis.

Fannie Mae and Freddie Mac - two bloated and corrupt government-sponsored programs - contributed heavily to the crisis.In order to prevent another crisis, we need to do what we should have done years ago - reform Fannie Mae and Freddie Mac. We also need to repeal Dodd-Frank, the Democrats' failed solution. Under Dodd-Frank, 10 banks too big to fail have become five banks too big to fail. Thousands of community banks have gone out of business.

Here's Hillary Clinton getting away with tying the Republicans to rich people. She's tying the Republican Party to Wall Street, to the big banks. She's tying the Republican Party to the financial crisis in 2008. It's all their fault. She's tying herself as with the low-income crowd - and the average, ordinary middle class American - as their champion, as their defender. They don't know that it's not the Republicans in bed with banks. They don't know that it's the banks that are practically paying for and underwriting the Democrat Party and Hillary Clinton today.