A Quote by Steve Mollenkopf

Look at smartphones. We are seeing growth almost like a barbell. You see lower-priced but high-volume growth in the developing world. But it ends up the average selling prices in the developing world are actually a lot higher than what people think.

Related Quotes

There's no growth. If China has a GDP of 7 percent, it's like a national catastrophe. We're down at 1 percent. And that's, like, no growth. And we're going lower, in my opinion. And a lot of it has to do with the fact that our taxes are so high, just about the highest in the world. And I'm bringing them down to one of the lower in the world.

Nobody in the developing world is going to take, as an answer to their aspirations, the developed world's reply: 'Sorry, you can't; we've already used it all up.' To earn the right to look the developing world in the eye and start this conversation, we need a reassessment of how we live and what we want.

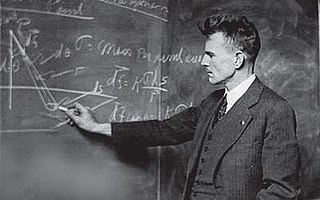

Growth, growth, growth -- that's all we've known . . . World automobile production is doubling every 10 years; human population growth is like nothing that has happened in all of geologic history. The world will only tolerate so many doublings of anything -- whether it's power plants or grasshoppers.

So, you're seeing the Rolls-Royces and the Bentley's still selling for big prices. You're seeing jewelry still selling, art works at auction. There was a diamond that sold for I think 38 million, 48 million, something like that just a week ago. So prices are back up to their highs, getting stronger and more and more people seem to have more and more money to spend.