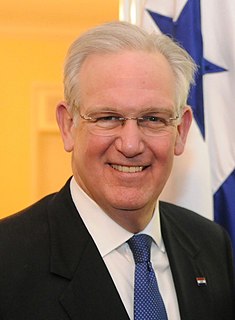

A Quote by Steve Scalise

You look at Rand Paul's bill. He's got refundable tax credits. So many other bills that are out there have had this. Dr. Tom Price, who is secretary of HHS under President Trump, he had an Obamacare repeal-and-replace bill that had tax credits.

Related Quotes

Labour ministers often look puzzled when reports show that Britain has one of the lowest levels of social mobility in the developed world. They just don't get it. They see poverty, inequality, fairness, as all about income. For the past 12 years, they have relied on tax credits to solve this. But tax credits do not solve poverty: they mask it.

New and expanded refundable tax credits would raise the fraction of taxpayers paying no income taxes to almost 50% from 38%. This is potentially the most pernicious feature of the president's budget, because it would cement a permanent voting majority with no stake in controlling the cost of general government.

Donald Trump had probably the biggest mandate to do things of any recent president because of the specifics of his agenda and his campaign. So many times a day he announced what he was gonna do. So he was elected, he won; therefore, he's got a mandate. And his party is not assisting and not helping, and they're even violating promises they made for seven years on the repeal and replace Obamacare.

Trump himself stands to benefit dramatically from the tax cuts. One of the things they're cutting is the alternative minimum tax. Last time we have tax returns for him was in 2005, where he paid about $31 million because of the alternative minimum tax. He won't have to pay that, if this tax bill goes through. So, not only is he reordering our constitutional democracy, he is personally enriching himself - which is not new, because, of course, he's done it ever since he swore an oath to become president of the United States.

The immigration bill - the new immigration bill - [Bill Clinton] has stripped the courts, which Congress can do under the leadership of the president, so that people who had a right to asylum or to petition - for asylum who were legal residents are now unable to go through because that part of the bill has been taken out.

My first match with Bill Goldberg, it was for the World Title in 1998. Bill had only been wrestling a year. Well, we stole the show. Because I was going to make Bill look as good as he was, and he was great. He had that incredible charisma, personality, and that 'it' factor. Rousey has that same thing.