A Quote by Terry McAuliffe

I invested in many companies, and I'm happy this one worked. This is capitalism. You invest in stock, it goes up, it goes down. You know, if you don't like capitalism, you don't like making money with stock, move to Cuba or China.

Related Quotes

Here’s how to know if you have the makeup to be an investor. How would you handle the following situation? Let’s say you own a Procter & Gamble in your portfolio and the stock price goes down by half. Do you like it better? If it falls in half, do you reinvest dividends? Do you take cash out of savings to buy more? If you have the confidence to do that, then you’re an investor. If you don’t, you’re not an investor, you’re a speculator, and you shouldn’t be in the stock market in the first place.

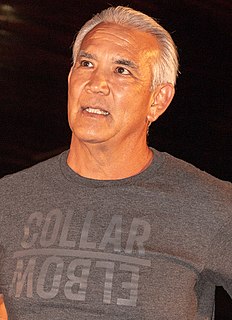

When you are a face for a long time and you turn heel, your stock value immediately goes up, especially if you're able to pull it off in the ring and on the mic. Then you ride that horse as long as you can. When it starts to falter, and when attendance drops, then you can turn back babyface. And your stock value goes up again.

Look, rich people already have a lot of money. There's literally trillions of dollars in cash held by corporations, their stock valuations at an all-time high. They do not need a tax cut to do anything. They can invest now, if they wanted to. They don't want to, because they can make more money just by mergers and stock buybacks and stuff like that. So, this is really just sort of a travesty.

There's a real difference between venture capitalism and vulture capitalism. Venture capitalism we like. Vulture capitalism, no. And the fact of the matter is that he's going to have to face up to this at some time or another, and South Carolina is as good a place to draw that line in the sand as any.

Unfortunately, our stock is somehow not well understood by the markets. The market compares us with generic companies. We need to look at Biocon as a bellwether stock. A stock that is differentiated, a stock that is focused on R&D, and a very, very strong balance sheet with huge value drivers at the end of it.