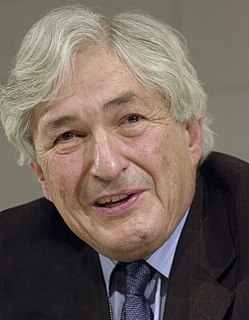

A Quote by Thomas Pogge

The World Bank is the monopoly provider of poverty data and, partly due to a leadership change there, the World Bank's reporting has been heavily on the rosy side since about 2000. The Bank's cultivation of an upbeat picture affords a very interesting lesson in statistics and how you can, depending on which numbers you present and how you present them, create a more positive or more negative impression of the evolution of poverty.

Quote Topics

Related Quotes

I went to the library and learned how checks work. I found out that routing numbers are like zip codes: the checks are sent to the bank that correlates to the routing number. If I manipulate those numbers to a bank far away, it would take longer to get back to the bank, which gave me more time to write more bad checks.

What we've done last night is what I call pushing back the risks..If there is a risk in a bank, our first question should be 'Okay, what are you in the bank going to do about that? What can you do to recapitalise yourself? If the bank can't do it, then we'll talk to the shareholders and the bondholders, we'll ask them to contribute in recapitalising the bank, and if necessary the uninsured deposit holders.

So: if the chronic inflation undergone by Americans, and in almost every other country, is caused by the continuing creation of new money, and if in each country its governmental "Central Bank" (in the United States, the Federal Reserve) is the sole monopoly source and creator of all money, who then is responsible for the blight of inflation? Who except the very institution that is solely empowered to create money, that is, the Fed (and the Bank of England, and the Bank of Italy, and other central banks) itself?

When I talk about an "empathy bank," I don't mean literally opening up a bank and putting in deposits. What I mean is that the more we can, as individuals and as members of a community, empathize with, understand the pain and uncertainty economic crisis causes other people, the more we lay the groundwork for political change.