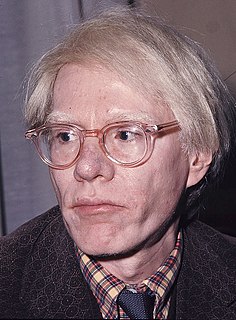

A Quote by Tracey Emin

My work rarely comes up in secondary market, so it means that my prices stay low.

Related Quotes

High prices can be the result of speculation, and maybe plunging prices can be attributed to the end of speculation, but low prices over time aren't caused by speculation. That's oversupply, mainly by Saudi Arabia flooding the market with low-priced oil to discourage rival oil producers, whether it's Russian oil or American fracking.

In a narrow market, when prices are not getting anywhere to speak of but move within a narrow range, there is no sense in trying to anticipate what the next big movement is going to be. The thing to do is to watch the market, read the tape to determine the limits of the get nowhere prices, and make up your mind that you will not take an interest until the prices breaks through the limit in either direction.

The tragedy of government welfare programs is not just wasted taxpayer money but wasted lives. The effects of welfare in encouraging the break-up of low-income families have been extensively documented. The primary way that those with low incomes can advance in the market economy is to get married, stay married, and work—but welfare programs have created incentives to do the opposite.

These results add up to perhaps the most important investment lesson of all that can be drawn from this week's market anniversaries: Predicting turns in the market is incredibly difficult to do consistently well. That means that, if your investment strategy going forward is dependent on your anticipating major market turning points, your chances of success are extremely low.

There is no such thing as agflation. Rising commodity prices, or increases in any prices, do not cause inflation. Inflation is what causes prices to rise. Of course, in market economies, prices for individual goods and services rise and fall based on changes in supply and demand, but it is only through inflation that prices rise in aggregate.