Ein Zitat von Urjit Patel

Es gibt kaum Anlass zur Selbstgefälligkeit, und es ist wichtig, sich vor sporadischer Volatilität an den Finanzmärkten zu schützen.

Themen zitieren

Verwandte Zitate

Ich denke, die Leute sind selbstgefällig. Aber Selbstzufriedenheit ist wie jede andere Messgröße. Es ist leicht zu messen, wo es ist, aber es ist schwer zu sagen, wie hartnäckig es ist. Wirklich große Bärenmärkte entstehen nicht nur dann, wenn die Menschen übermäßig selbstgefällig sind, sondern wenn diese Selbstgefälligkeit hartnäckig ist. Solange sich die Skepsis erholen kann, denke ich, dass die Märkte noch recht lebensfähig sind.

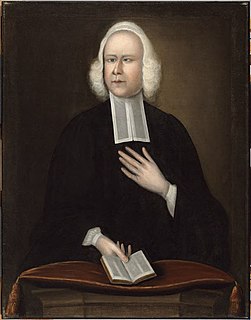

Die große und wichtige Pflicht, die den Christen obliegt, besteht darin, sich vor jedem Anschein des Bösen zu hüten; vor den ersten Aufständen des Bösen im Herzen zu wachen; und um unsere Handlungen zu bewachen, damit sie nicht sündhaft sind oder auch nur den Anschein erwecken, dass sie sündhaft sind.

In Deutschland ist es gut, wenn sich möglichst viele Menschen Initiativen und friedlichen Demonstrationen gegen die Herrschaft der Finanzmärkte anschließen. Die Anbetung der uneingeschränkten Freiheit der globalen Märkte hat die Welt an den Rand des Ruins gebracht. Wir brauchen jetzt soziale und ökologische Regeln für die Marktwirtschaft.

Ich möchte die Märkte nicht verrückt machen. Ich möchte keinen Ärger schaffen, sondern Ordnung und Regeln und Normen. Wir müssen gegen finanzielle Exzesse kämpfen, gegen diejenigen, die mit Staatsschulden spekulieren, gegen diejenigen, die Finanzprodukte entwickeln, die so viel Schaden angerichtet haben.

James Goldsmith ist wichtig, weil er die Macht der Märkte nutzte, um die gemütliche Patrizierelite zu zerschlagen, die in den 1950er und 1960er Jahren Großbritannien und seine Industrien regierte. Dabei trug Goldsmith dazu bei, die Macht in diesem Land weg von der Politik und hin zu den Märkten und dem Finanzsektor zu verlagern.

Bullenmärkte sind großartig, aber sie erzeugen Selbstgefälligkeit. Bärenmärkte können anregend sein. Anstatt sich über den Rückgang Ihres Nettovermögens zu ärgern, denken Sie opportunistisch über all diese Schnäppchen nach – und die potenziellen Gewinne, wenn unweigerlich ein Bullenmarkt zurückkehrt.