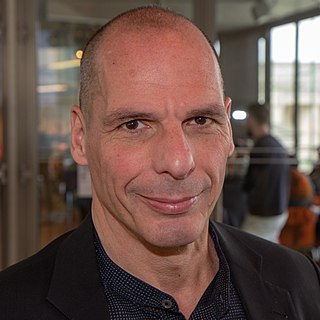

A Quote by Wolfgang Kubicki

The Netherlands, Ireland, Luxembourg and others, exactly. We have to take a close look at their tax regimes, particularly if we want to move forward with European integration. We can't have a situation in which some EU member states enrich themselves at the expense of their partners.

Related Quotes

Membership in the European Community, now the European Union, has enabled Ireland to re-find its sense of participation - cultural, political, social - at the European level. I think that also opens up possibilities for Ireland as a European country to look outward - to look particularly, for example, at countries to which a lot of Irish people emigrated, to our links - our human links - with the United States, with Canada, with Australia, with New Zealand. And to look also, because of our history, at our links to the developing countries.

I want to end tax dumping. States that have a common currency should not be engaged in tax competition. We need a minimum tax rate and a European finance minister, who would be responsible for closing the tax loopholes and getting rid of the tax havens inside and outside the EU. It is also clear that we have to reach common standards in our economic and labor policies. We cannot continue to just talk about technical details. We have to inspire enthusiasm in Germany for Europe.

Over the longer term, the institutions and powers of the EU will continue to expand and certain policymaking powers, heretofore vested in the member states, will be delegated or transferred to, or pooled and shared with EU institutions. As a result, the sovereignty of the member states will increasingly be eroded.

We [European countries] probably need to move forward together, each at their own speed. The faster ones, that could be the countries in the euro zone. The others would be those who are interested in the continued development of the common market, but reject the idea of an ever stronger political integration.

European Union partners never said European Union partners're going to renege on any promises, European Union partners said that European Union partners promises concern a four-year parliamentary term, european Union partners will be spaced out in an optimal way, in a way that is in tune with our bargaining stance in Europe and also with the fiscal position of the Greek state.

Now people are criticizing Europe, the European Commission, Juncker and the whole lot because the distribution of refugees didn't succeed immediately. But you also have to recognize that close to 20,000 refugees have already been redistributed. There are only a few member states that do not want to take part.

To promote the process of European integration, we must improve an institutional mechanism already existing in the European Union, reinforced co-operation, by making it more flexible and effective. This approach allows a few states to move faster and further... We are all aware that this mechanism is vital.

I should also say that apart from the negotiations that are taking place within the WTO, we are ourselves involved in all manner of bilateral negotiations, or, if they are not bilateral, with the South African Customs Union and the European Union. All the member countries of the European Union have now ratified the agreement that we have with the EU and that opens up the EU market in various ways.

Let's take the nine states that have no income tax and compare them with the nine states with the highest income tax rates in the nation. If you look at the economic metrics over the last decade for both groups, the zero-income-tax-rate states outperform the highest-income-tax-rate states by a fairly sizable amount.