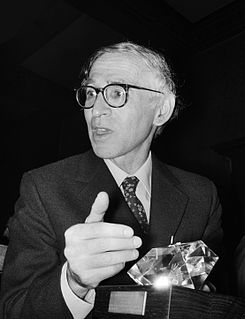

A Quote by Aaron Klug

The work requires a moderately large investment in technological and theoretical developments and long periods of time to carry them out, without the pressure to achieve quick or short term results.

Related Quotes

Value investing doesn't always work. The market doesn't always agree with you. Over time, value is roughly the way the market prices stocks, but over the short term, which sometimes can be as long as two or three years, there are periods when it doesn't work. And that is a very good thing. The fact that our value approach doesn't work over periods of time is precisely the reason why it continues to work over the long term.

Being captive to quarterly earnings isn't consistent with long-term value creation. This pressure and the short term focus of equity markets make it difficult for a public company to invest for long-term success, and tend to force company leaders to sacrifice long-term results to protect current earnings.

The most important thing that a company can do in the midst of this economic turmoil is to not lose sight of the long-term perspective. Don't confuse the short-term crises with the long-term trends. Amidst all of these short-term change are some fundamental structural transformations happening in the economy, and the best way to stay in business is to not allow the short-term distractions to cause you to ignore what is happening in the long term.

The thing that I learned early on is you really need to set goals in your life, both short-term and long-term, just like you do in business. Having that long-term goal will enable you to have a plan on how to achieve it. We apply these skills in business, yet when it comes to ourselves, we rarely apply them.

Frequent comparative ranking can only reinforce a short-term investment perspective. It is understandably difficult to maintain a long-term view when, faced with the penalties for poor short-term performance, the long-term view may well be from the unemployment line ... Relative-performance-oriented investors really act as speculators. Rather than making sensible judgments about the attractiveness of specific stocks and bonds, they try to guess what others are going to do and then do it first.

I report the assault on nature evidenced in coal mining that tears the tops off mountains and dumps them into rivers, sacrificing the health and lives of those in the river valleys to short-term profit, and I see a link between that process and the stock-market frenzy which scorns long-term investments-genuine savings-in favor of quick turnovers and speculative bubbles whose inevitable bursting leaves insiders with stuffed pockets and millions of small stockholders, pensioners, and employees out of work, out of luck, and out of hope.

We want everything in a hurry because our primary aim must be survival in the short term. Long term thinking has seemed like a luxury in human history because lives were shorter, but with our increased longevity we have to figure out what to DO with all our time, and to pace ourselves to achieve things that we want. Hobbes might have been right when he originally wrote that life is 'nasty, poor, brutish and short', but today we are AWASH with time.