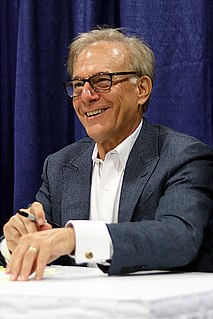

A Quote by Adair Turner, Baron Turner of Ecchinswell

Rising inequality can create a more highly leveraged economy, and it can then make the economy vulnerable to a crash like 2008.

Related Quotes

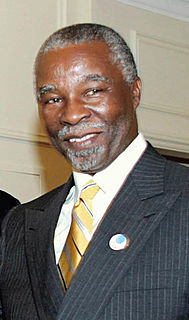

When I was in government, the South African economy was growing at 4.5% - 5%. But then came the global financial crisis of 2008/2009, and so the global economy shrunk. That hit South Africa very hard, because then the export markets shrunk, and that includes China, which has become one of the main trade partners with South Africa. Also, the slowdown in the Chinese economy affected South Africa. The result was that during that whole period, South Africa lost something like a million jobs because of external factors.

Ontario's auto sector is a cornerstone of our economy - a key source of our ability to export, innovate and create jobs. In this highly competitive global economy, we need to drive further investment and ensure the sector remains strong. I am confident that this new partnership, with Ray Tanguay's strategic advice and leadership, will allow Ontario to increase our competitiveness, productivity, and market share in the auto sector, and I look forward to their important work contributing to a more prosperous, innovative Ontario economy.

The impact of QE on generating more lending by Wall Street to Main Street and in generating more employment and increasing overall investment in the economy is quite modest. QE probably limited the initial collapse of the economy in 2008, and likely had a very small positive impact on economic growth, but its broader impact on jobs and growth in the economy seems not very big.

The reality is the most important thing that can be done are these permanent changes like to the tax code, reduction of government spending. These are the things that pop up in economy and move it in the right direction, start to make it an economy that is moving because of the money in the private economy. When you think about it, when the Fed is lowering an interest rate, what it's doing is it's creating more liquidity. It's putting more money into the economy. The same thing happens when you reduce the tax except if happens from physical policy.

Today it's fashionable to talk about the New Economy, or the Information Economy, or the Knowledge Economy. But when I think about the imperatives of this market, I view today's economy as the Value Economy. Adding value has become more than just a sound business principle; it is both the common denominator and the competitive edge.