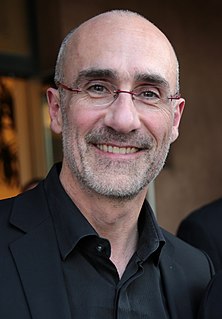

A Quote by Adam Davidson

A majority of Americans support Social Security and Medicare, a progressive tax system and a government that regulates business in the public interest, but most share deep skepticism about the government's ability to do all this well.

Related Quotes

On issue after issue, the polls - and these are not snapshot polls; these are polls over a consistent period of time - show that most Americans share what one could call core liberal or progressive values: investment in health care and education over tax cuts; fair trade over free trade; corporate accountability over deregulation; environmental protection over laissez-faire policies; defending Social Security and Medicare over privatizing them; raising the minimum wage over eliminating it. The country prefers progressive alternatives to the failed policies of the conservative right.

Politicians like to talk about the income tax when they talk about overtaxing the rich, but the income tax is just one part of the total tax system. There are sales taxes, Medicare taxes, social security taxes, unemployment taxes, gasoline taxes, excise taxes - and when you add up all of those taxes [many of which are quite regressive], and then you look at how they affect the rich and the poor, you essentially end up with a system in which the best off 20 percent of Americans pay one percentage point more of their income than the worst off 20 percent of Americans.

... between government, business, and the public, there is a triangular community of interest. Clearly, it is in business' interest to shape its behavior to prevailing public values; it is more efficient to do so than not to do so. It is also clear that government is the high-cost alternative through which public values are imposed on corporations that do not accurately perceive these values.

There is no tax policy that better describes how out of touch America's liberals are with the rest of the country than the estate tax. According to the Left, government seizure of a large share of the wealth of an American taxpayer is a moral imperative that serves social justice. Most Americans disagree, big time.

Unlike most government programs, Social Security and, in part, Medicare are funded by payroll taxes dedicated specifically to them. Some of the tax revenue pays for current benefits; anything that's left over goes into trust funds for the future. The programs were designed this way for political reasons.

Try not to be too angry or disappointed with your fellow Americans. Most of them don't care about politics as much as the majority of my readers, and the education they have received about it from the government's public school system is nothing more than a septic tank full of warmed-over self-serving statist lies and leftist propaganda.

For Social Security to be financially sound, the federal government should have $100 trillion - a sum of money six-and-a-half times the size of our entire economy - in the bank and earning interest right now. But it doesn't. And while many believe that Social Security represents our greatest entitlement problem, Medicare is six times larger in terms of unfunded obligations.