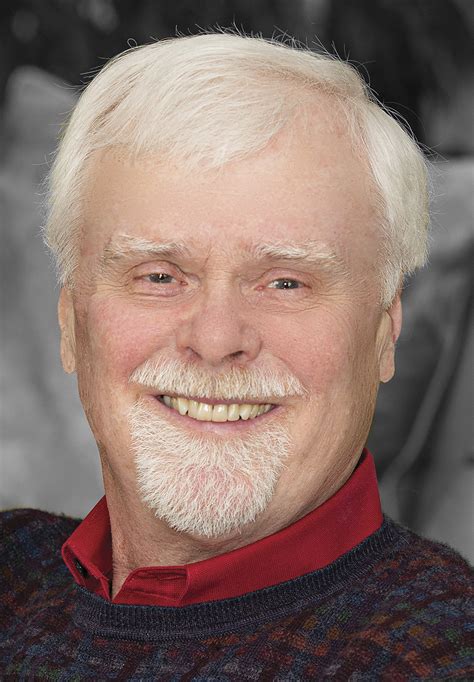

A Quote by Adam Davidson

The idea of confidence, of the emotions of the population, is an incredibly important one in economics. John Maynard Keynes called it 'animal spirit.' And if people are feeling generally good about the future, they're more likely to spend money, to start new companies; companies are more likely to hire people, make investments.

Related Quotes

People who expect to feel guilty tend to be more sympathetic, to put themselves into other people's shoes, to think about the consequences of their behaviour before acting, and to treasure their morals. As a result they are less prone to lie, cheat or behave immorally when they conduct a business deal or spot an opportunity to make money, studies suggest. They are also likely to make better employees because people who think less about the future results of their actions are more likely to be late, to steal or to be rude to clients.

For centuries, economic thinkers, from Adam Smith to John Maynard Keynes, have tried to identify the elusive formula that makes some countries more prosperous and successful than others. My curiosity about this topic spurred me, as a young professor of economics in the late 1970s, to research new ways of measuring national competitiveness.

This idea of anticipation is key to investing and to business generally. You can't wait for an opportunity to become obvious. You have to think, "Here's what other people and companies have done under certain circumstances. Now, under these new circumstances, how is this management likely to behave?"

Drug companies spend more on advertising and marketing than on research, more on research on lifestyle drugs than on life saving drugs, and almost nothing on diseases that affect developing countries only. This is not surprising. Poor people cannot afford drugs, and drug companies make investments that yield the highest returns.

One of the most important skills of the economist, therefore, is that of simplification of the model. Two important methods of simplification have been developed by economists. One is the method of partial equilibrium analysis (or microeconomics), generally associated with the name of Alfred Marshall and the other is the method of aggregation (or macro-economics), associated with the name of John Maynard Keynes.

We have a lot of really great companies in Canada, and I think there's always been this fear that 'great' in Canada doesn't mean great on a world stage. We need more self-confidence. We are building incredibly good businesses with incredibly good people, being loyal, dedicating themselves to solving important problems.

When the trust is high, you get the trust dividend. Investors invest in brands people trust. Consumers buy more from companies they trust, they spend more with companies they trust, they recommend companies they trust, and they give companies they trust the benefit of the doubt when things go wrong.

Many companies believe incentives, financial incentives, are the answer to every problem or issue. But people are motivated by much more than money. In particular, people like to feel good about themselves and maintain their self-esteem. If companies spent more time working on people's feelings of self-worth, they wouldn't have to try, often unsuccessfully, to bribe people to do work.

The best way to encourage economic vitality and growth is to let people keep their own money.When you spend your own money, somebody's got to manufacture that which you're spending it on. You see, more money in the private sector circulating makes it more likely that our economy will grow. And, incredibly enough, some want to take away part of those tax cuts. They've been reading the wrong textbook. You don't raise somebody's taxes in the middle of a recession. You trust people with their own money. And, by the way, that money isn't the government's money; it's the people's money.

People who graduate are more resilient financially, and they weather economic downturns better than people who don't graduate. And, throughout their lives, people who graduate are more likely to be economically secure, more likely to be healthy, and more likely to live longer. Face it: A college degree puts a lot in your corner.

I've seen the same thing emerge in the research around the interaction of sleeping and moving and eating: if you get a good night's sleep, you are significantly more likely to make the right choices about what you eat the next morning, you're more likely to work out, you're more likely to get a better night's sleep the next night.