A Quote by Adam Lashinsky

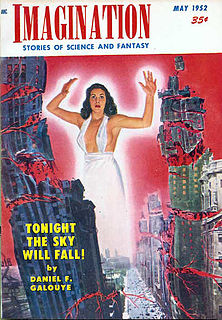

ICG wasn't an index fund so much as a collection of venture-capital investments focused on so-called business-to-business Internet companies.

Related Quotes

The big advantage that we have as a venture capital firm over a hedge fund or a mutual fund is we have a 13-year lockup on our money. And so enterprise can go in and out of fashion four different times, and we can go and invest in one of these companies, and it's okay, because we can stay the course.

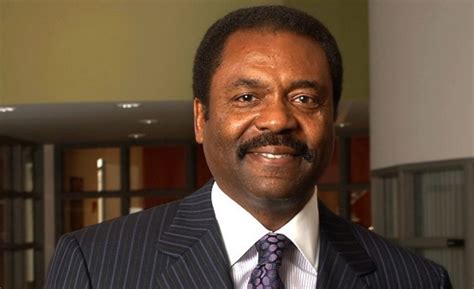

Some people would argue the other side: that the business of business is business, and companies should only be focused on profits. But in today's world, I don't think corporations can only be focused on profits, because they are inextricably linked with the communities that they serve. I do not believe you can be a leader in your industry without being a leader in your community. It's a fundamental shift in how you think about business.

Northleaf is delighted to have been chosen to manage the new fund. We look forward to implementing the fund's long-term strategy of constructing a portfolio of high-potential venture capital funds with the scale and resources to execute their plans, support successful high-growth companies and deliver world-class returns.

I'm amazed by the potential of more companies employing integrated philanthropic initiatives at earlier stages in their life cycle. What if this were done on an even more massive scale? Consider what would happen if a top-tier venture-capital firm required the companies in which it invested to place 1% of their equity into a foundation serving the communities in which they do business.

There is always a critical job to be done. There is a sales door to be opened, a credit line to be established, a new important employee to be found, or a business technique to be learned. The venture investor must always be on call to advise, to persuade, to dissuade, to encourage, but always to help build. Then venture capital becomes true creative capital - creating growth for the company and financial success for the investing organization