A Quote by Adam Lashinsky

What makes Samsung so mysterious is that it's not altogether clear who leads the company or what its leaders do. The company follows an avowedly Confucian model of consensus-driven decision-making, values bone-crushingly hard work, and shows tremendous deference to the founding Lee family, despite its lack of a controlling interest in its shares.

Related Quotes

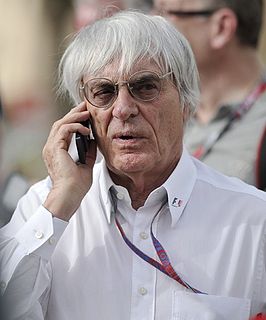

Probably when I gave things to Slavica [ Ecclestone], you know the shares of the company, and things like that. And she put it all in trust and the trust sold the shares. Um, would I turn the clock back if I could and so I still owned the company completely? Probably yes. It probably wasn't a good decision, but it was the decision that had to be made. Was I happy that I made it? No.

The best CEOs in our research display tremendous ambition for their company combined with the stoic will to do whatever it takes, no matter how brutal (within the bounds of the company's core values), to make the company great. Yet at the same time they display a remarkable humility about themselves, ascribing much of their own success to luck, discipline and preparation rather than personal genius.

It's the job of any business owner to be clear about the company's nonnegotiable core values. They're the riverbanks that help guide us as we refine and improve on performance and excellence. A lack of riverbanks creates estuaries and cloudy waters that are confusing to navigate. I want a crystal-clear, swiftly flowing stream.

Level 5 leaders are differentiated from other levels of leaders in that they have a wonderful blend of personal humility combined with extraordinary professional will. Understand that they are very ambitious; but their ambition, first and foremost, is for the company's success. They realize that the most important step they must make to become a Level 5 leader is to subjugate their ego to the company's performance. When asked for interviews, these leaders will agree only if it's about the company and not about them.

In a large pharmaceutical company, where it's a big bet, you're going to need finance people to be involved in the decision-making because the investment can run into the hundreds of millions of dollars. You're going to have to run scenarios. You might even need agreement from the C.E.O. to make that type of decision. If it's an incremental, low-cost decision in a marketing-oriented company, it may be a very different set of stakeholders a lot further down in the organization.