A Quote by Adam McKay

In general foreign invested companies who come to America to start a company, to open a manufacturing business or whatnot, they actually provide much higher wages than American companies.

Related Quotes

Requiring the payment of higher wages will lead to a loss of some jobs and a raising of prices which drives companies to search for automation to reduce costs. On the other hand, those receiving higher wages will spend more (the marginal propensity to consume is close to 1 for low income earners) and this will increase demand for additional goods and services. Henry Ford had the clearest vision of why companies can actually benefit by paying higher wages.

If you talk privately to our tech companies, our pharmaceutical companies, our high-end manufacturing companies, the high end of America, where the good-paying jobs are, China is not letting them in unless China gets to steal their intellectual property in a company that`s 51 percent owned by the Chinese.

I am proud of the fact that the U.K. is an open trading country. I welcome inward investment such as that of Nissan, and the takeover of struggling British companies by foreign companies who turn them around, as in the case of Jaguar Land Rover. I also accept that job losses sometimes have to occur to restore failing companies to health.

In those countries where income taxes are lower than in the United States, the ability to defer the payment of U.S. tax by retaining income in the subsidiary companies provides a tax advantage for companies operating through overseas subsidiaries that is not available to companies operating solely in the United States. Many American investors properly made use of this deferral in the conduct of their foreign investment.

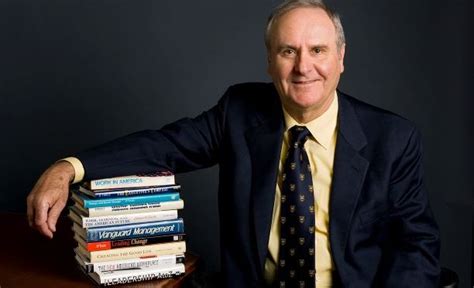

In a nutshell, the ability of American companies to compete in world markets depends on creating conditions in which workers can add sufficient value to justify their higher wages and benefits, much the Japanese auto manufacturers have done in this country. Until unions and mangers understand the necessity of effectively employing the nation's most important resource, the American worker, we are destined to have more Detroits.