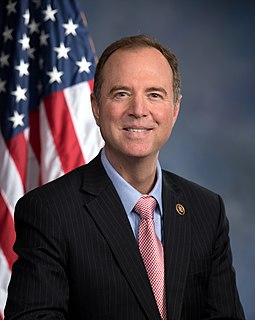

A Quote by Adam Schiff

The U. S. trade deficit with China shows that while we value the potential of their market, they value the reality of our market. It is in this area that we should use our leverage.

Related Quotes

The latest trade of a security creates a dangerous illusion that its market price approximates its true value. This mirage is especially dangerous during periods of market exuberance. The concept of "private market value" as an anchor to the proper valuation of a business can also be greatly skewed during ebullient times and should always be considered with a healthy degree of skepticism.

During the 1999 debate over Permanent Normal Trade Relations with China President Bill Clinton said, 'In opening the economy of China, the agreement will create unprecedented opportunities for American farmers, workers and companies to compete successfully in China's market. WRONG: Our trade deficit with China has increased from $83 billion in 2001 to a record breaking $342 billion in 2014.

If in the human economy, a squash in the field is worth more than a bushel of soil, that does not mean that food is more valuable than soil; it means simply that we do not know how to value the soil. In its complexity and its potential longevity, the soil exceeds our comprehension; we do not know how to place a just market value on it, and we will never learn how. Its value is inestimable; we must value it, beyond whatever price we put on it, by respecting it.

Value investing doesn't always work. The market doesn't always agree with you. Over time, value is roughly the way the market prices stocks, but over the short term, which sometimes can be as long as two or three years, there are periods when it doesn't work. And that is a very good thing. The fact that our value approach doesn't work over periods of time is precisely the reason why it continues to work over the long term.

It can be shown that maximum diversification is achieved by holding each stock in proportion to its value to the entire market (italics added)... Hindsight plays tricks on our minds... often distorts the past and encourages us to play hunches and outguess other investors, who in turn are playing the same game. For most of us, trying to beat the market leads to disastrous results... our actions lead to much lower returns than can be achieved by just staying in the market.

Fair Trade is a market-based, entrepreneurial response to business as usual: it helps third-word farmers developing direct market access as well as the organizational and management capacity to add value to their products and take them directly to the global market. Direct trade, a fair price, access to capital and local capacity-building, which are the core strategies of this model, have been successfully building farmers' incomes and self-reliance for more than 50 years.