A Quote by Adam Smith

When the profits of trade happen to be greater than ordinary, over-trading becomes a general error both among great and small dealers.

Related Quotes

As long as I can remember I feel I have had this great creative and spiritual force within me that is greater than faith, greater than ambition, greater than confidence, greater than determination, greater than vision. It is all these combined. My brain becomes magnetized with this dominating force which I hold in my hand.

You must ignore what everyone else is doing and trade only when you feel the odds are in your favor. In short, trade only when you and you alone are comfortable that the expected return of your trades will be positive. That might mean you'll have to sit out a few parties, but it will also mean that you'll have more profits over the course of your trading career.

The Internet rewards scale; by trading higher up-front costs for lower marginal cost, market leaders can invest in better technology and service. As a result, there is nothing online that is both great in quality and small in scale. Amazon wasn't originally a better bookstore than the small shops we mourn, but it is now.

Don’t ever average losers. Decrease your trading volume when you are trading poorly; increase your volume when you are trading well. Never trade in situations where you don’t have control. For example, I don’t risk significant amounts of money in front of key reports, since that is gambling, not trading.

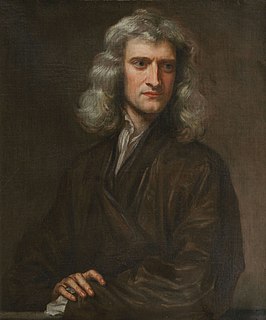

As Attraction is stronger in small Magnets than in great ones in proportion to their Bulk, and Gravity is greater in the Surfaces of small Planets than in those of great ones in proportion to their bulk, and small Bodies are agitated much more by electric attraction than great ones; so the smallness of the Rays of Light may contribute very much to the power of the Agent by which they are refracted.

Therefore, if a great kingdom humbles itself before a small kingdom, it shall make that small kingdom its prize. And if a small kingdom humbles itself before a great kingdom, it shall win over that great kingdom. Thus the one humbles itself in order to attain, the other attains because it is humble. If the great kingdom has no further desire than to bring men together and to nourish them, the small kingdom will have no further desire than to enter the service of the other. But in order that both may have their desire, the great one must learn humility.

You can walk with the Shintoist through his sacred groves, or chant an affirmation with the Hindu on the banks of the Ganges...and still be a student of Unity... As the Christ becomes greater to you in Unity, the Buddha also becomes greater, and the greater the Buddha becomes, the greater the Christ becomes.