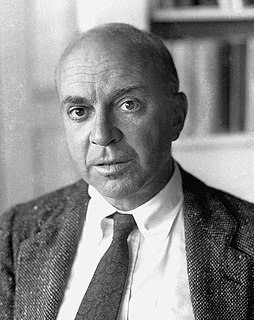

A Quote by Adi Godrej

You can't have a regime which continuously subsidizes things; as inflation rises, you keep prices of certain things unchanged.

Related Quotes

There is no such thing as agflation. Rising commodity prices, or increases in any prices, do not cause inflation. Inflation is what causes prices to rise. Of course, in market economies, prices for individual goods and services rise and fall based on changes in supply and demand, but it is only through inflation that prices rise in aggregate.

[The masses] ... must turn their hopes toward a miracle. In the depths of their despair reason cannot be believed, truth must be false, and lies must be truth. "Higher bread prices," "lower bread prices," "unchanged bread prices" have all failed. The only hope lies in a kind of bread price which is none of these, which nobody has ever seen before, and which belies the evidence of one's reason.

The people of the United States have been fortunate in many things. One of the things in which we have been most fortunate has been that so far, due perhaps to certain basic virtues in our traditional ways of doing things, we have managed to keep the crisis of western civilization, which has devastated the rest of the world and in which we are as much involved as anybody, more or less at arm's length.

The good thing about the dividend-paying stocks is, first of all you have stocks, which are real assets if we have some inflation. I think we're going to have 2%, 3% maybe 4%. That's a sweet spot for stocks. Corporations do well with that. It gives them pricing power. Their assets move up with prices. I'm not fearful of that inflation.

There are certain things in which one is unable to believe for the simple reason that he never ceases to feel them. Things of this sort - things which are always inside of us and in fact are us and which consequently will not be pushed off or away where we can begin thinking about them - are no longer things; they, and the us which they are, equals A Verb; an IS.

It's better not to know so much about what things mean or how they might be interpreted or you'll be too afraid to let things keep happening. Psychology destroys the mystery, this kind of magic quality. It can be reduced to certain neuroses or certain things, and since it is now named and defined, it's lost its mystery and the potential for a vast, infinite experience.

No politician can praise unemployment or inflation, and there is no way of combining high employment with stable prices that does not involve some control of income and prices. Otherwise the struggle for more consumption and more income to sustain it-a struggle that modern corporations, modern unions and modern democracy all facilitate and encourage-will drive up prices. Only heavy unemployment will then temper this upward thrust. Not many wish to confront the truth that the modern economy gives a choice only between inflation, unemployment, or controls.