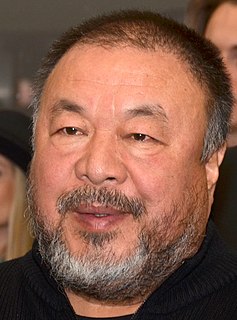

A Quote by Ai Weiwei

Selling high or low doesn't mean anything. It has to do purely with the market.

Related Quotes

The great multinationals are unwilling to face the moral and economic contradictions of their own behavior - producing in low-wage dictatorships and selling to high-wage democracies. Indeed, the striking quality about global enterprises is how easily free-market capitalism puts aside its supposed values in order to do business. The conditions of human freedom do not matter to them so long as the market demand is robust. The absence of freedom, if anything, lends order and efficiency to their operations.

Basically my point of view on unicorns is that private companies which have sky high valuations, it doesn't really mean anything in the real world until it's marked to market. And there's only two ways things get marked to market in venture capital: Either a company is acquired by another company for cash or marketable security, or it goes public, and then it has reporting requirements and then the market will determine the value.

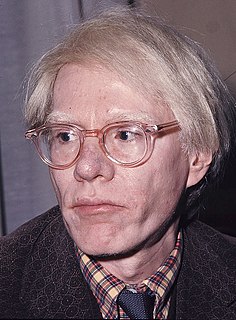

Network marketing is based purely on relationship selling, which is the state of the art in selling today. Small and large companies throughout the country and the world are realizing that individuals selling to their friends and associates is the future of sales, because the critical element in buying is trust.

Intellectual culture seems to separate high art from low art. Low art is horror or pornography or anything that has a physical component to it and engages the reader on a visceral level and evokes a strong sympathetic reaction. High art is people driving in Volvos and talking a lot. I just don't want to keep those things separate. I think you can use visceral physical experiences to illustrate larger ideas, whether they're emotional or spiritual. I'm trying to not exclude high and low art or separate them.