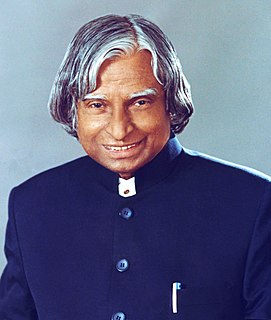

A Quote by Ajay Piramal

Normally, Indian companies follow the trend set by companies abroad. There is usually a long lag period.

Related Quotes

I think that we can all learn from what smart companies are doing. My objective is to demonstrate what's possible, even during tough economic times. This is a period of great business dislocation, but that means it's also the time to try new things. This will be a challenge for existing companies. But the behaviors of smart companies can be learned.

European and American companies companies do create jobs for some people but what they're mainly going to do is make an already wealthy elite wealthier, and increase its greed and strong desire to hang on to power. So immediately and in the long run, these companies - harm the democratic process a great deal.

Companies watch what consumers are doing like a hawk. Just as one letter to a politician can signal an insipient problem, for companies, a trend where people are beginning to switch away from one of their key products to a rival offering on the basis of either claims or real improvements on performance, that's significant.

Companies aren’t families. They’re battlefields in a civil war. Yet despite this capacity for internecine warfare, most companies roll along relatively peacefully, year after year, because they have routines—habits—that create truces that allow everyone to set aside their rivalries long enough to get a day’s work done.