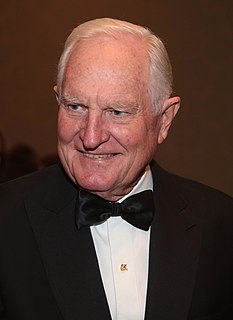

A Quote by Ajaypal Singh Banga

The 2.5 billion adults [around the world] without access to financial services are disproportionately women and young people. There are at least 44 million unbanked or underbanked people in the United States, so clearly financial inclusion is needed in all markets.

Related Quotes

I've said to [Donald Trump], and I think others have said to him that the day that he is the President of the United States, there are world capitals and financial markets and people all around the world who take really seriously what he says, and in a way that's just not true before you're actually sworn in as president.

The division of the United States into federations of equal force was decided long before the Civil War by the high financial powers of Europe. These bankers were afraid that the United States, if they remained in one block and as one nation, would attain economic and financial independence, which would upset their financial domination over the world. The voice of the Rothschilds prevailed... Therefore they sent their emissaries into the field to exploit the question of slavery and to open an abyss between the two sections of the Union.

Ebay was involved and gave up 150 million passwords. Target was attacked and gave up 40 million credit card numbers. Attacks like these are happening on a regular basis, both in the United States and around the world and the costs in terms of privacy or security in our financial sector are truly extraordinary.

By any measure, CapitalSource outperformed both our direct competitors and the financial services industry in general, particularly in the context of the near collapse of the financial services industry where 19 of the 20 largest financial institutions in the country either failed or were bailed out by the government.