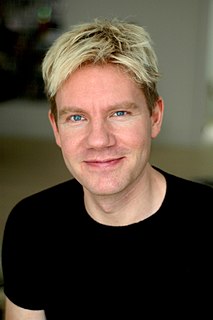

A Quote by Al Gore

There's such a wide variation in tax systems around the world, it's difficult to imagine a harmonized CO2 tax that every country agrees to. That's not in the cards in the near term. But the countries that are doing the best job, like Sweden, are already doing both of these. I think that eventually we'll use both of them but we need to get started right away and the cap-and-trade is a proven and effective tool.

Related Quotes

Eventually we'll use a CO2 tax offset by a reduction in taxes elsewhere alongside a cap-and-trade plan, but the degree of difficulty associated with a CO2 tax far exceeds that with a cap-and-trade plan. We're seeing it's hard to get a cap-and-trade plan and it's much easier to use as a basis for a global agreement than a CO2 tax.

To some, a cap-and-trade system might sound like a neat approach where the market sorts everything out. But in fact, in some ways it is worse than a tax. With a tax, the costs are obvious. With a cap-and-trade system, the costs are hidden and shifted around. For that reason, many politicians tend to like it. But that is dangerous.

We need to put a price on carbon, and that's what cap-and-trade does and that's also what a CO2 tax does. As long as our current valuation in the marketplace tells us every minute of every day that it's perfectly all right to dump 90 million tons of global warming into the thin atmosphere surrounding the planet every 24 hours as if that atmosphere is an open sewer, then the individual actions are not going to solve the problem.

It takes a number of different skill sets, I think, to try and be a good producer. You have to be very creative, but you also have to be incredibly financially minded. I jokingly say the job is kind of part cheerleader and part dictator. It is both of those things, because you have to make sure that people are doing what they need to be doing, but creatively you really need to be helping each person in every job across the crew. Cheering them on, keeping them inspired into doing their best work, and you have the director's vision in the forefront.

I'm not shy about stating my opinion on political issues, so I can state my opinion, which is, on this one, Premier Notley's right. Because cap and trade systems have not been shown to work. And if you want to price carbon, then I would listen to the CEO of Suncor, who suggests a clean, transparent carbon tax makes a bunch more sense than a cap and trade system that just creates jobs for traders. I - I kind of agree with that.

We need to lower tax rates for everybody, starting with the top corporate tax rate. We need to simplify the tax code. The ultimate answer, in my opinion, is the fair tax, which is a fair tax for everybody, because as long as we still have this messed-up tax code, the politicians are going to use it to reward winners and losers.

I support both a Fair Tax and a Flat Tax plan that would dramatically streamline the tax system. A Fair Tax would replace all federal taxes on personal and corporate income with a single national tax on retail sales, while a Flat Tax would apply the same tax rate to all income with few if any deductions or exemptions.