A Quote by Alan Carr

Let's be honest, you're very selfish in your twenties, and in your thirties you are just trying to get a down payment for your flat or enough money to pay your bills.

Related Quotes

We all live in an ongoing series of calamities. I don't know of any individual who doesn't have a series of calamities. Life doesn't operate where, you make a certain amount of money, you pay your bills, you move on from day-to-day-to-day. No! What happens is, you make your money, you pay your bills, and then a new bill comes up that's completely unexpected.

Your post-college years should be an exploratory time in your professional life. From your early twenties and on into your early thirties, you should feel free to explore your professional prospects. Keep an open mind, and don't expect to get everything right straight out of the gate. Be prepared to start over once or twice.

As a young actor, there's a very small group of kids, just a handful. As you get older, all of a sudden, there's a bunch of guys your age that work. It's a very different experience when you used to be on the short list because you were young and there's only so many kids that can do the work and then all of a sudden you're in your twenties and thirties and there's a whole bunch of guys that can do your work.

You do certain things in your twenties that are just not appropriate in your thirties and certainly not appropriate in your forties. Eventually you even the scales, and it's time to move on and become an adult and start working hard again and going to sleep a little bit earlier. Fortunately, I got a job to facilitate that transition.

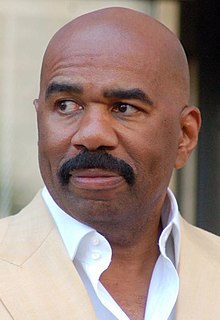

I'm here to tell you, though, ladies that the term "gold digger" is one of the traps we men set to keep you off our money trail; we created that term for you so that we can have all our money and still get everything we want from you without you asking for or expecting this very basic, instincual responsibility that men all over the world are obligated to assume and embrace. ... KNOW THIS: It is your right to expect that a man will pay for your dinner, your movie ticket, your club entry fee, or whatever else he has to pay for in exhange for your time.

The debt settlement company will direct you to stop paying your creditor and instead send the money directly to them each month. The company's goal is to demonstrate to your creditor that you don't have the money to pay up - that's your leverage. After a few months, the company will typically go to the creditor and say, "I'm holding X dollars on behalf of your customer. He doesn't have the money to pay you, so you should take this amount as a settlement or you'll end up with nothing." If the creditor wants to get paid badly enough, it will take the money.

Senior executives can, after a fashion, get a portion of their pay tax-free. You defer part of your income and not have to pay taxes on it, and then when you retire you have the company buy a life insurance policy on you using that money. The company can deduct that money because it is a business expense, and the money will get paid out to your children or grandchildren when you die, so you have effectively given them your money and it's never been taxed.