A Quote by Alan Greenspan

Finance is wholly different from the rest the economy.

Related Quotes

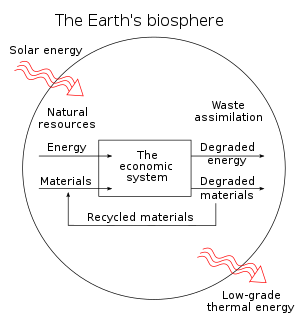

Most people think of the economy as producing goods and services and paying labor to buy what it produces. But a growing part of the economy in every country has been the Finance, Insurance and Real Estate (FIRE) sector, which comprises the rent and interest paid to the economy's balance sheet of assets by debtors and rent payers.

The word Gothic, in the sense in which it is generally employed, is wholly unsuitable, but wholly consecrated. Hence we accept it and we adopt it, like all the rest of the world, to characterize the architecture of the second half of the Middle Ages, where the ogive is the principle which succeeds the architecture of the first period, of which the semi-circle is the father.

So, what people are actually left with to spend is maybe 25 to 30% of their income on goods and services, after paying taxes and after paying the FIRE sector (Finance, Insurance, Real Estate). Whether it's housing insurance or mortgage insurance. So there's an idea of distracting people. Don't think of your condition. Think of how the overall economy is doing. But don't think of the economy as an overall unit. Think of the stock market as the economy. Think of the rich people as the economy. Look at the yachts that are made. Somebody's living a lot better. Couldn't it be you?