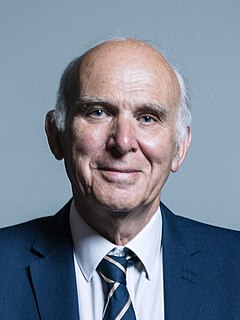

A Quote by Alan Greenspan

One of the problems with hedge funds is that they are changing so rapidly. If you have the balance sheet that closed business last night, by 11 A.M. this morning, that won't tell you very much about what they're doing.

Related Quotes

When I was 23, 24, I started covering hedge funds - a lot of this was luck - when no one else did. This was before hedge funds were the prettiest girl in school: this was pre-nose job and treadmill for hedge funds, when nobody talked to them - back then, it was just all about insurance companies and money managers.

To minimize market uncertainty and achieve the maximum effect of its policies, the Federal Reserve is committed to providing the public as much information as possible about the uses of its balance sheet, plans regarding future uses of its balance sheet, and the criteria on which the relevant decisions are based.

I think there are probably too many hedge fund managers in the world, as well as active fund managers. The hedge fund industry is very efficient. We see a lot of hedge funds open and a lot close. It's very binary. You either succeed or fail in the hedge fund world. If you succeed, the amount the managers make it beyond most people's wildest dreams of wealth.