A Quote by Alan Greenspan

Remember what we're looking at. Gold is a currency. It is still, by all evidence, a premier currency, that no fiat currency, including the dollar, can match.

Related Quotes

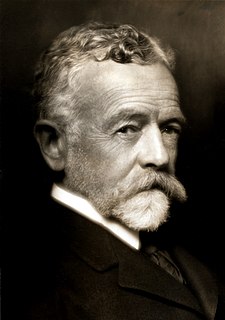

I hold all idea of regulating the currency to be an absurdity; the very terms of regulating the currency and managing the currency I look upon to be an absurdity; the currency should regulate itself; it must be regulated by the trade and commerce of the world; I would neither allow the Bank of England nor any private banks to have what is called the management of the currency.

What there is no dispute about is whether or not China is a currency manipulator. They are a currency manipulator. They actively intervene every single day to keep the value of their currency less than it would be against the dollar than if it floated freely. We think. Even China barely disputes that.

We are privileged that the dollar is the "currency of last resort" and the most important currency in the world. Global commodities are priced in dollars. Central banks in other countries hold great quantities of dollars. The dollar was the safe harbor, the port in the storm during the credit crisis.

My single biggest financial concern is the loss of the dollar as the reserve currency. I can't imagine anything more disastrous to our country. . .you're already seeing things in the markets that are suggesting that confidence in the dollar is waning. . .I think you could see a 25% reduction in the standard of living in this country if the U.S. dollar was no longer the world's reserve currency. That's how valuable it is.

The United States is pushing as policy division of the world into rival currency camps - the dollar area on the one hand, and the Russia-Chinese-Shanghai Cooperation Organization group on the other, especially now that the IMF has changed its rules. People think that if there are rival currency groupings and national currencies are going bust, we might as well use gold as a safe haven.

Most paper money initially existed as a substitute for gold. That's what gave it value. But right now what gives a currency value is other currency. Most countries hold reserves and the reserves are other currencies. If you are a backing up the euro with the dollar, what's backing up the dollar? I don't think it is going to go to a point where all you have is coins and bars of gold, but I do think that we are going to have to go back to a monetary system based in gold, not based on paper.

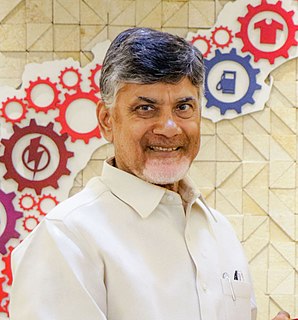

The regulator banned cryptocurrency... then there was an order from the Supreme Court. So, in the absence of any strong law, it was very important for us to come out with a comprehensive law-one for the private digital currency and second for the government for its digital form of currency, or the virtual currency.