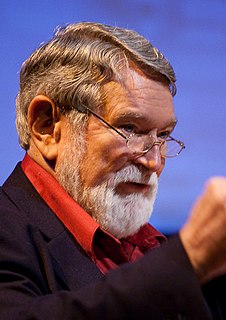

A Quote by Alan Greenspan

A decline in the national housing price level would need to be substantial to trigger a significant rise in foreclosures, because the vast majority of homeowners have built up substantial equity in their homes despite large mortgage-market financed withdrawals of home equity in recent years.

Related Quotes

Even though some down payments are borrowed, it would take a large, and historically most unusual, fall in home prices to wipe out a significant part of home equity. Many of those who purchased their residence more than a year ago have equity buffers in their homes adequate to withstand any price decline other than a very deep one.

I'm struck by the fact that by and large equity capital doesn't play a big role in new financing; it's either bonds or internal financing but not really equity. And therefore, it's not clear that anything which improves the equity markets has really much to do with the productivity of the economy as a whole.

As homeowners see the value of their homes decline, they become more likely to delay purchases of the big items - like automobiles, electronics and home appliances - that are ballasts of the American economy. When those purchases decline, large manufacturing firms, suddenly short on funds, could begin laying off employees.

Everybody would be better off if they could buy housing for only, let's say, a carrying charge of one-quarter of their income. That used to be the case 50 years ago. Buyers had to save up and make a higher down payment, giving them more equity - perhaps 25 or 30 percent. But today, banks are creating enough credit to bid up housing prices again.

Both HUD and the Department of Justice began bringing lawsuits against mortgage bankers when a higher percentage of minority applicants than white applicants were turned down for mortgage loans. A substantial majority of both black and white mortgage loan applicants had their loans approved but a statistical difference was enough to get a bank sued.