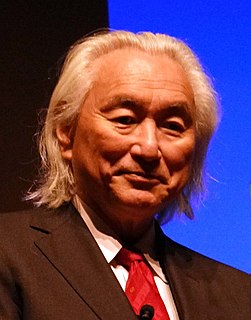

A Quote by Alan Guth

It’s hard to build models of inflation that don't lead to a multiverse. It’s not impossible, so I think there’s still certainly research that needs to be done. But most models of inflation do lead to a multiverse, and evidence for inflation will be pushing us in the direction of taking [the idea of a] multiverse seriously.

Related Quotes

I'm just interested in science, and I try to keep track of what's going on and get my head around it - inflation, the multiverse, whatever. It's very hard for me because I don't have a scientific background, and I wasn't any good at science at school, but all of that stuff I just find incredibly attractive and fascinating.

The unique aspect of today's monetary inflation is that it is not limited to one country, but a host of countries are all inflating together. As a result of the monetary inflation (when all of the newly created money begins to leave the banks and enter the system), the price inflation will be worldwide.

I think democracies are prone to inflation because politicians will naturally spend [excessively] - they have the power to print money and will use money to get votes. If you look at inflation under the Roman Empire, with absolute rulers, they had much greater inflation, so we don't set the record. It happens over the long-term under any form of government.

Significant changes in the growth rate of money supply, even small ones, impact the financial markets first. Then, they impact changes in the real economy, usually in six to nine months, but in a range of three to 18 months. Usually in about two years in the US, they correlate with changes in the rate of inflation or deflation."

"The leads are long and variable, though the more inflation a society has experienced, history shows, the shorter the time lead will be between a change in money supply growth and the subsequent change in inflation.

Modern thinking is that time did not start with the big bang, and that there was a multiverse even before the big bang. In the inflation theory, and in string theory, there were universes before our big bang, and that big bangs are happening all the time. Universes are formed when bubbles collide or fission into smaller bubles.