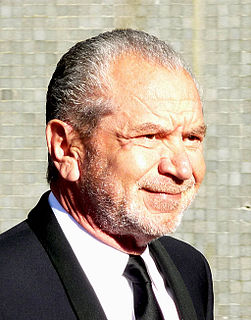

A Quote by Alan Sugar

My history of lending money from banks is that they want to know the ins and outs of the backside of a duck.

Related Quotes

I was always accused of being too stiff. In 1974, when I ran my first primary race for state rep, I was chief aide to the speaker of the House, I knew the issues and understood state government. But what I found out the hard way is that you can know all the ins and outs but people want to know you, your family.

If two parties, instead of being a bank and an individual, were an individual and an individual, they could not inflate the circulating medium by a loan transaction, for the simple reason that the lender could not lend what he didn't have, as banks can do. Only commercial banks and trust companies can lend money that they manufacture by lending it.