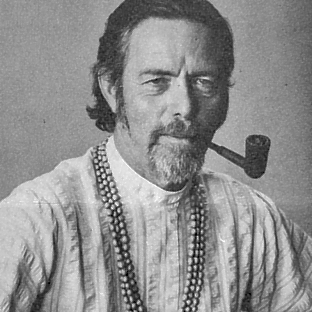

A Quote by Albert Camus

Note, besides, that it is no more immoral to directly rob citizens than to slip indirect taxes into the price of goods that they cannot do without.

Related Quotes

Going to war accelerated the move from indirect to direct rule. Almost any state that makes war finds that it cannot pay for the effort from its accumulated reserves and current revenues. Almost all war-making states borrow extensively, raise taxes, and seize the means of combat - including men - from reluctant citizens who have other uses for their resources.

What we're talking about is the price of goods, all goods, in terms of money. That has nothing to do with unemployment, except for the fact that you get fewer goods. And when you have more money and fewer goods, the amount of dollars per good goes up. It goes up because there are fewer goods and it goes up because there is more money.

It is certain that despotism ruins individuals by preventing them from producing wealth much more than by depriving them of what they have already produced; it dries up the source of riches, while it usually respects acquired property. Freedom, on the contrary, produces far more goods than it destroys; and the nations which are favored by free institutions invariably find that their resources increase even more rapidly than their taxes.

Jefferson, though the secret vote was still unknown at the time had at least a foreboding of how dangerous it might be to allow the people to share a public power without providing them at the same time with more public space than the ballot box and with more opportunity to make their voices heard in public than on election day. What he perceived to be the mortal danger to the republic was that the Constitution had given all power to the citizens, without giving them the opportunity of being citizens and of acting as citizens.

Your prosperity consciousness is not dependent on money; your flow of money is dependent on your prosperity consciousness. As you can conceive of more, more will come into your life. There is an ocean of abundance available! There is plenty for everyone. You cannot rob another and they cannot rob you, and in no way can you drain the ocean dry... there is always more.