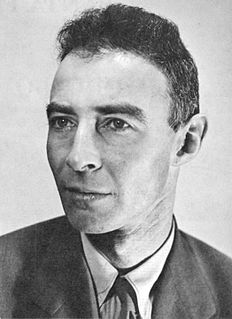

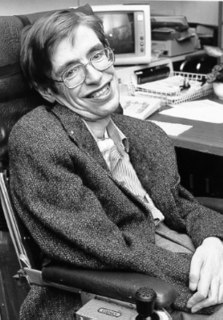

A Quote by Albert Einstein

Compound interest on debt was the banker's greatest invention, to capture, and enslave, a productive society.

Quote Topics

Related Quotes

There is a third silent party to all our bargains. The nature and soul of things takes on itself the guaranty of the fulfillment of every contract, so that honest service cannot come to loss. If you serve an ungrateful master, serve him the more. Put God in your debt. Every stroke shall be repaid. The longer the payment is withholden, the better for you; for compound interest on compound interest is the rate and usage of this exchequer.

The art of banking is always to balance the risk of a run with the reward of a profit. The tantalizing factor in the equation is that riskier borrowers pay higher interest rates. Ultimate safety - a strongbox full of currency - would avail the banker nothing. Maximum risk - a portfolio of loans to prospective bankrupts at usurious interest rates - would invite disaster. A good banker safely and profitably treads the middle ground.

There are many points in the history of an invention which the inventor himself is apt to overlook as trifling, but in which posterity never fail to take a deep interest. The progress of the human mind is never traced with such a lively interest as through the steps by which it perfects a great invention; and there is certainly no invention respecting which this minute information will be more eagerly sought after, than in the case of the steam-engine.

Shipping first time code is like going into debt. A little debt speeds development so long as it is paid back promptly with a rewrite. The danger occurs when the debt is not repaid. Every minute spent on not-quite-right code counts as interest on that debt. Entire engineering organizations can be brought to a standstill under the debt load of an unconsolidated implementation, object-oriented or otherwise.

This debt crisis coming to our country. The wall and tidal wave of debt that is befalling our nation. Medicare and Social Security go bankrupt within ten years, we have a debt that is looming so high that in the last year of President Obama's budget just the interest payments on our debt is $916 billion dollars.