A Quote by Alex Berenson

Climate change might be disastrous, but does that mean we want carbon taxes that raise the price of a gallon of heating oil to $10? And how exactly will those taxes affect economic growth?

Related Quotes

The left does understand how raising taxes reduces economic activity. How about their desire for increasing cigarette taxes, soda taxes? What are they trying to do? Get you to buy less. They know. They know that higher taxes reduce activity. It's real simple: If you want more of an activity, lower taxes on it. If you want less of an activity, raise taxes. So if you want more jobs? It's very simple. You lower payroll taxes. If you don't want as many jobs, then you raise corporate taxes. It's that simple, folks.

We need to use economic instruments such as carbon taxes, cap and trade, tax and dividend and whatever else to help incentivize behavior that will move us to a post-carbon, post-animal agriculture world, and make our societies more resilient to the shocks that are already baked into the system. But that doesn't make climate change an "economic issue."

The government taxes you when you bring home a paycheck.

It taxes you when you make a phone call.

It taxes you when you turn on a light.

It taxes you when you sell a stock.

It taxes you when you fill your car with gas.

It taxes you when you ride a plane.

It taxes you when you get married.

Then it taxes you when you die.

This is taxual insanity and it must end.

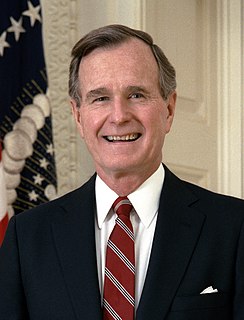

I'm the one who will not raise taxes. My opponent now says he'll raise them as a last resort, or a third resort. But when a politician talks like that, you know that's one resort he'll be checking into. My opponent, my opponent won't rule out raising taxes. But I will. And The Congress will push me to raise taxes and I'll say no. And they'll push, and I'll say no, and they'll push again, and I'll say, to them, Read my lips: no new taxes.

With a congressional mandate to run the deficit up as high as need be, there is no reason to raise taxes now and risk aggravating the depression. Instead, Obama will follow the opposite of the Reagan strategy. Reagan cut taxes and increased the deficit so that liberals could not increase spending. Obama will raise spending and increase the deficit so that conservatives cannot cut taxes. And, when the economy is restored, he will raise taxes with impunity, since the only people who will have to pay them would be rich Republicans.

I'm not going to tell people that I will raise your incomes and not your taxes, and not mean it, because I don't want to see the kind of struggle that the middle class is going through exemplified by these promises that would raise taxes and make it much more difficult for many, many Americans to get ahead and stay ahead. That is not my agenda.

We now know that climate action does not require economic sacrifice. This is fully in line with the World Bank Group's findings. It is up to all of us to make smart policy choices that will help combat climate change. For example, putting a price on carbon is a necessary step and could drive resources and investments to a cleaner economy.

Politicians like to talk about the income tax when they talk about overtaxing the rich, but the income tax is just one part of the total tax system. There are sales taxes, Medicare taxes, social security taxes, unemployment taxes, gasoline taxes, excise taxes - and when you add up all of those taxes [many of which are quite regressive], and then you look at how they affect the rich and the poor, you essentially end up with a system in which the best off 20 percent of Americans pay one percentage point more of their income than the worst off 20 percent of Americans.