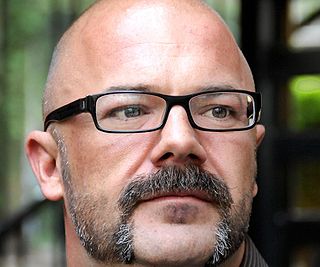

A Quote by Alex Berenson

Volatility may be rising simply because investors must digest more information every day.

Related Quotes

I think people who read Internet blogs are usually trying to fit it in during a busy part of their day, and there's only so much information that you digest. Whereas an experience with a book is a little more comfortable, and I think people are a little more willing to really delve into information.

But to procrastinate and prevaricate simply because you're afraid of erring, when others - I mean our brethren in Germany - must make infinitely more difficult decisions every day, seems to me almost to run counter to love. To delay or fail to make decisions may be more sinful than to make wrong decisions out of faith and love.

As individuals die every moment, how insensitive and fabricated a love it is to set aside a day from selfish routine in prideful, patriotic commemoration of tragedy. Just as God is provoked by those who tithe simply because they feel that they must tithe, I am provoked by those who commemorate simply because they feel that they must commemorate.

I believe that good investors are successful not because of their IQ, but because they have an investing discipline. But, what is more disciplined than a machine? A well-researched machine can make many average investors redundant, leaving behind only the really good human investors with exceptional intuition and skill.

Investors frequently benefit from making decisions with less than perfect knowledge and are well rewarded for bearing the risk of uncertainty. The time other investors spend delving into the last unanswered detail may cost them the chance to buy into situations at prices so low they offer a margin of safety despite the incomplete information

I don't work all day, every day on 'Rizzoli & Isles,' but I work every day. It may be a scene or two, or it may be an enormous workload, but there's really not a lot of room for anything else, and that's the choice I made. And that's why I stayed away from TV before: Because I know that that's what it is.